College basketball’s version of the Super Bowl just ended Monday night…

The University of Connecticut beat San Diego State University to win the NCAA title. It was the Huskies’ fifth national championship – and their first with coach Dan Hurley.

But like most sporting events these days, the biggest winner didn’t even take the court…

I’m talking about the sportsbooks.

We’re still waiting on the final numbers. But before the 68-team tournament started, a survey from the American Gaming Association predicted big spending from gamblers…

Roughly 68 million adults in the U.S. planned to bet $15.5 billion on the games this year. That’s about $500 million less than this year’s Super Bowl. But it’s also 18 million more bettors.

The spread of legalized gambling across the U.S. is no longer a secret. In the years ahead, more states will allow it. And of course, that’s great news for the companies in this space.

As I’ll show you today, one industry leader is thriving so far this year. And it’s positioned to keep growing as legalized gambling spreads across the country.

But right now, it’s not a great stock to own…

In short, Wall Street is once again getting excited about DraftKings (DKNG).

The betting giant crashed roughly 85% from its March 2021 peak through late 2022. But it has bounced back so far this year. It’s up around 75% from its December 27 low.

As you might expect, growth is DraftKings’ strong suit…

Its revenue has grown 1,068% in the past five years. That’s a 63% annual growth rate. And it’s not done yet…

DraftKings’ online offerings are now legal in around two-thirds of the 50 states and Washington, D.C. But so far, it only operates in 20 states. It’s working to expand its operations in the other places.

Plus, as I said, industry analysts expect more states to legalize gambling in the years ahead. And they believe future rollouts will power DraftKings to 17% annual revenue growth through 2030.

Like many emerging growth companies, DraftKings is in the red. The company lost $3.14 per share in 2022. But the experts think it’s moving in the right direction…

Wall Street analysts expect a smaller loss of $2 per share this year. They predict that the company will push through the breakeven level in 2026. And they expect it to make about $2.70 per share in profit by the end of the decade.

That’s a great growth story. It seems like DraftKings will thrive over the long term.

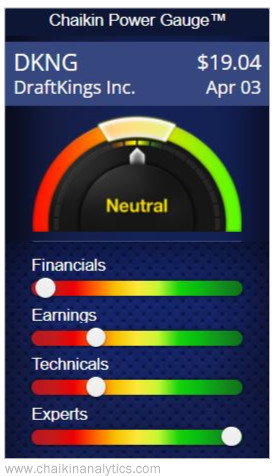

However, the Power Gauge is telling a different version of DraftKings’ story. It’s currently waving a yellow (“neutral”) flag about the stock. Take a look…

The Power Gauge grades DraftKings as “bearish” or worse in three of the four factor categories. As you can see, the Experts category is the one bright spot for the company…

It’s “very bullish” overall. And four out of the five factors earn “very bullish” ratings as well.

In other words, a clear discrepancy exists between the expectations of the experts on Wall Street and the Power Gauge’s ratings. That serves as a warning for investors like us…

We need to consider DraftKings’ growth forecasts – and its competitors.

Many folks think DraftKings is the big gorilla in the online sports-betting (“OSB”) industry. But that’s not the case…

As a whole, the OSB industry reaches 45% of the U.S. population. And FanDuel, the company’s largest rival, owns a small edge in market share.

The problem for DraftKings is… the growth potential in this space also applies to FanDuel.

Now, it would still be OK if DraftKings could out-market FanDuel and inspire customer loyalty. But don’t count on that happening…

The competition to get and keep customers in the OSB space is expensive. These companies spend a ton on massive advertising campaigns and aggressive promotions.

DraftKings simply isn’t equipped for that kind of bare-knuckle marketing fight…

In 2022, the company spent $1.9 billion on “Selling, General, and Administrative” expenses. This segment covers marketing, promotions, and advertising costs.

Those expenses amounted to a whopping 86% of DraftKings’ sales. That led to a $1.5 billion operating loss for the company last year.

In comparison, FanDuel’s parent company Flutter Entertainment (PDYPY) spent 45% of its sales on these types of expenses. And it logged a $9.3 billion operating profit.

DraftKings realizes that Wall Street wants it to control costs. In February, company management said it’s “more focused than ever on expense management.”

But DraftKings is still caught between a rock and a hard place…

Managing expenses while fighting a marketing battle against a powerful rival is hard.

And in this case, I’ll side with the Power Gauge over Wall Street’s analysts…

I don’t always oppose owning “neutral” stocks. But I’ll pass on DraftKings today.

Good investing,

Marc Gerstein