Always worrying about what could go wrong doesn’t make me “bearish”…

It makes me a market strategist.

For example, I’m worried about the unemployment rate right now. It’s at 3.8%. That’s not far from its all-time low. And it has stayed below 4% since the end of 2021.

But layoffs have been on the rise this year…

Microsoft (MSFT), CVS Health (CVS), FedEx (FDX), Tyson Foods (TSN), General Motors (GM), T-Mobile (TMUS), and Roku (ROKU) are some of the bigger companies to announce job cuts in the past two months alone. These moves account for thousands of positions.

Just last week, tech giant Google reportedly let go of hundreds of recruiting staff members. That news is more significant when you consider that its parent company, Alphabet (GOOGL), already eliminated 12,000 jobs (about 6% of its workforce) back in January.

When I start worrying about what could go wrong, it’s easy to go down a rabbit hole of doom and gloom. But at some point, as market strategists, we need to be realistic as well…

One thing on my radar is how the Federal Reserve will react if unemployment starts rising.

The central bank typically lowers the federal funds rate when that happens. (In case you don’t know, the federal funds rate is simply the interest rate that banks can earn when they lend money overnight to other banks. It’s the benchmark interest rate in the U.S.)

The combination of unemployment and the federal funds rate is my “worry indicator”…

Specifically, I overlay these two key rates on the same chart. When I do that, a clear pattern emerges.

You see, higher rates are a byproduct of a strong economy.

But at some point, things get too hot. Then, inflation shows up. And it becomes the Federal Reserve’s No. 1 enemy. That’s what we’ve seen over the past year and a half.

When rates are higher, risk increases as well.

For nearly 70 years, since the mid-1950s, my worry indicator has activated every time. By that, I mean the unemployment rate always rises after the Fed hikes the federal funds rate.

Then, when unemployment climbs, the Fed retaliates by lowering rates.

Here’s the important part…

Every time the Fed does that, the markets react negatively – at first. But eventually, the benefits of lower rates jump-start the economy again. And the business cycle resumes.

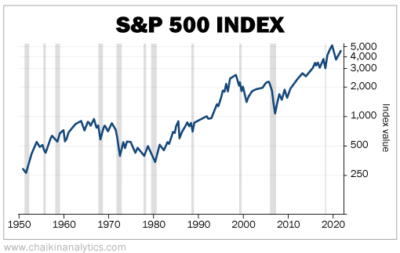

Look at the following chart of the S&P 500 Index since 1950…

When a recession starts, stocks retreat. That’s because the economy is slowing. Falling rates soon follow. And eventually, the markets recover and move higher. Take a look…

The reality is simple today…

We’re at least months away from the Fed cutting rates. And if history is any proof, the stock market won’t like the move after everyone realizes it’s because things are slowing down.

But don’t worry…

That means we’re still early in the process this time. It also means this rate cycle is working.

And before we know it, stocks will be on sale again.

Good investing,

Pete Carmasino