Folks, the market is complicated. But ultimately, one thing is the key to success…

Stock prices are based on expected earnings growth and price-to-earnings (P/E) ratios.

It’s just that simple.

Now, before we get started, it’s important to understand that I’m not supporting or dismissing growth or value investing. The Power Gauge rightfully accounts for both styles.

Any P/E ratio is OK (or even cheap) if investors expect the company to grow enough in the future. Conversely, any P/E ratio is excessive if we don’t think earnings will grow enough.

Specifically, we’ll use “projected P/E” today. That’s simply the current price of a stock divided by the company’s estimated earnings per share (“EPS”) over its next fiscal year.

To show you what I mean, let’s look at the technology sector…

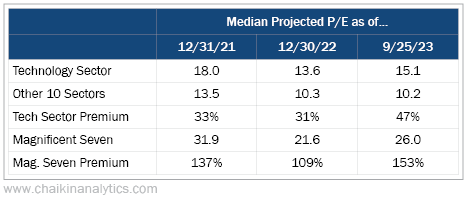

The following table shows the median projected P/E ratios for the tech space, the other 10 market sectors, and the so-called “Magnificent Seven” tech stocks over the past three years.

Regular readers know all about the Magnificent Seven. It’s the flashy nickname for the seven stocks that are driving the market higher – Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA).

In the table, I’ve also included the projected P/E premiums for the tech sector and the Magnificent Seven (compared to all other market sectors). Higher premiums mean more investors are optimistic. So it’s a great way to see what’s loved or not. Take a look…

First, notice that the premiums for the tech sector and the Magnificent Seven fell in 2022.

That’s not surprising since interest rates rose throughout the year. And higher rates often limit growth.

But you can also see that the premiums for the tech sector and the Magnificent Seven stocks bounced back this year. In fact, they’ve moved even higher.

And remember, that move happened even though interest rates remain high today.

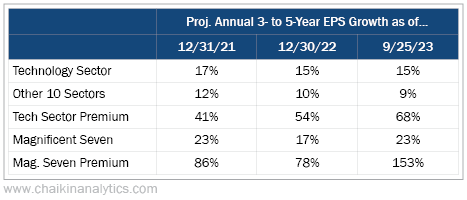

Of course, growth expectations are key. So the higher projected P/E premiums aren’t a problem if the tech sector and the Magnificent Seven are expected to grow enough.

But as you can see in the next table, that isn’t happening in the tech sector…

At the end of last year, the tech sector’s projected annual EPS growth over the next three to five years was 15%. And it’s still 15% right now.

In other words, the sector’s projected P/E premiums rose without lower rates and without stronger growth projections. Investors just became more attracted to these stocks.

Now, we’re talking about median values. In some cases, growth expectations likely do justify higher projected P/E premiums. But the Magnificent Seven is in a world of its own…

Notice that the median growth expectations for these seven stocks recovered to its 2021 level. But importantly, they’re now trading at a huge premium over the rest of the market.

As investors, we should be leery of that type of extreme today…

Avoid buying the Magnificent Seven if you don’t believe in the big growth projections.

Ultimately, it’s about whether these expectations are strong enough – and believable enough – to justify the projected P/E premiums. So let me ask you a simple question…

Do you expect the Magnificent Seven to close this 150%-plus premium gap?

Good investing,

Marc Gerstein