As parents, we spend many years handholding our children…

After all, they’re not expected to know everything. And they’re not expected to do a whole heck of a lot either – at least, not at first.

But we do all that with one important expectation in mind…

Eventually, we expect our children to grow into fully functioning adults. We expect them to “launch.”

We do the same thing as investors, too. Think about the handholding and leeway we give so-called “growth stocks”…

Often, like our kids, those companies haven’t launched yet. They’re still taking steps toward becoming fully functioning businesses.

Of course, losses at these types of companies tend to be the rule, not an exception. It takes time for a new business to get off the ground…

Fixed costs exist from day one. But it can take years for new – and especially “disruptive” – businesses to generate enough revenue to at least cover those expenses…

During that period, these companies often burn through a lot of cash. As a result, they need to cover their needs with outside capital (debt, venture capital, publicly traded shares of stock, or a combination of those things).

But the thing is… some of these companies never grow up.

What happens then? Do you want the equivalent of a video-game-playing grown-up living in your portfolio rent-free?

Heck no!

It’s one thing to give your kids an extra year at home. But you don’t want them living in your basement forever. And it’s the same thing with these “failure to launch” companies…

Put simply, failure-to-launch companies are duds. And importantly, they all share a specific attribute. It makes them darn risky for investors…

They can’t survive if the capital markets lose confidence.

Think about it… In bad times, investors flee from businesses that look like they’ll never get off the ground. And when that happens, collapse is nearly guaranteed.

Fortunately, one metric can help us differentiate between genuine up-and-coming growth companies and failure-to-launch duds… I’m talking about “operating margin.”

This metric focuses on the company’s ability to generate enough revenue to meet the essential costs of staying in business. By that, we’re referring to things like paying employees, paying for facilities, buying supplies or inventories, and more.

Importantly, negative operating margins are a red flag to help us spot potential duds. That’s especially true when those margins aren’t improving.

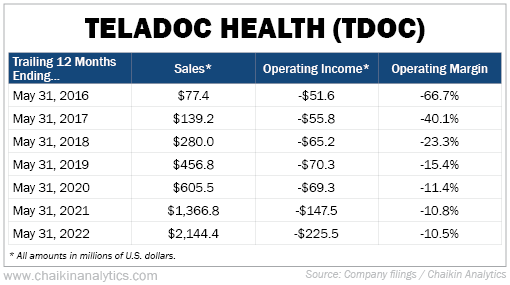

For example, look at Teladoc Health’s (TDOC) operating margins over the past seven years…

Now, as an investor, I could live with Teladoc’s negative operating margin in the early years. It isn’t unusual for companies to burn a lot of cash in their early days. But these companies should still show enough forward progress to satisfy the capital markets.

However, Teladoc isn’t doing that. Its revenue jumped 369% from the 12 months ending on May 31, 2019, through the present. And yet, the company is hardly making any progress with operating margins.

That’s alarming. It’s as if our kid tried walking on his or her own, fell down on the carpet… and then just gave up.

Readers with access to our Chaikin Analytics platform can use a quick hack to spot this kind of danger…

In addition to Power Gauge scores, our platform also provides several other pieces of data for every stock. A couple of those items are “P/E” (which is price divided by the estimate of next year’s earnings per share) and “ROE” (five-year average return on equity).

If both numbers are negative, there’s a good chance that the company’s operating margins are unacceptable.

It’s your money. Be demanding. Don’t let these basement-dwelling kids wreck your returns.

With all that said, sometimes it’s OK to own shares of companies like this. I’ll explain what I mean tomorrow morning.

Good investing,

Marc Gerstein