Editor’s note: Regular Chaikin PowerFeed readers know we’re bullish on stocks in 2024…

We’ve also shared similar sentiments from the folks at our corporate affiliate Stansberry Research. Most recently, you heard from Sean Michael Cummings earlier this month.

Today, we’re turning things over to another Stansberry Research editor and good friend… Brett Eversole.

This essay first appeared in Brett’s free DailyWealth e-letter on February 1. In it, he explains that a bubble is popping right now in the markets. And it’s actually a good sign…

The pandemic broke the global economy…

We watched it happen in real time. But it’s even more obvious with the benefit of hindsight. The government shut down most of the economy… put it on life support with stimulus… and opened it back up months later.

It was financial intervention on a scale we’ve never seen before. And the aftereffects still linger on – especially if you look in certain areas.

One of those places is the automotive market… specifically, used vehicles. Used-car prices soared and have since collapsed. And I expect prices to fall further in the months to come…

Supply-chain disruptions slammed the automotive industry in the thick of the pandemic.

Carmakers often couldn’t get the computer chips they needed in the last steps of assembly. Thousands of vehicles – otherwise ready for delivery – sat waiting for those final parts.

It made for a scene I had personally never seen before… empty dealership lots. There was basically no inventory available. To make matters worse, this happened at a time when Americans had spare cash to burn, thanks to stimulus payments. Folks were looking to buy.

The result was a bubble in the used-vehicle market. Prices nearly doubled in less than two years. For a time, the average used car was more expensive than the average new one.

It was an unsustainable move higher. That’s why used-car prices have collapsed in the past two years…

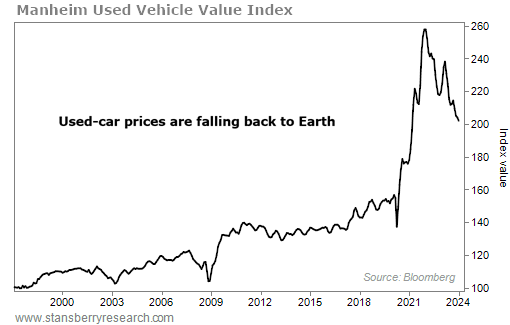

We can see this rise and fall by looking at the Manheim Used Vehicle Value Index. This index has tracked the price change of the used-vehicle market since 1997. Take a look…

Like other big-ticket items, prices for used vehicles tend to be slow movers. They drift higher and might fall a bit during economic slowdowns.

The pandemic-induced supply shock changed that. Used-car prices surged 88% from their bottom in April 2020 to their high in January 2022.

At the time, everyone knew the rally couldn’t last. But no one knew how long it would take for the world to get back to normal – and for prices to reverse. Fortunately for would-be buyers, that reversal is now underway…

The Manheim index is down 22% over the past two years. But we can expect prices to keep falling even further in the months ahead.

Thanks to more than two decades of data, we have an idea of how much downside remains…

This index rose about 2% a year, up until the start of the pandemic. We’re now four years past the pre-pandemic level. If you take those pre-pandemic levels and grow them by 2% for four years, the index should be closer to 170 today.

That means prices need to fall another 16% from here just to get “back to normal.” And if you assume a 4% annual growth rate instead of 2%, the implied downside is still nearly 10%.

In short, we’ve seen a bubble inflate and begin to deflate. But the decline isn’t over yet. And we should expect another double-digit fall before it ends.

As investors, it’s great to see more of the pandemic-induced craziness leaving the market. It means we’re returning to a more “normal” economy, with less uncertainty… two factors that tend to push stocks higher.

Good investing,

Brett Eversole

Editor’s note: In his DailyWealth e-letter, Brett and his team explain more than just the day-to-day opportunities they see in the markets. They also share strategies that can help you safely and steadily build a lifetime of wealth.

Like the Chaikin PowerFeed, you can receive DailyWealth for free in the morning every weekday the markets are open. Learn more and sign up by clicking here.