Editor’s note: Investors should never fear new highs…

It’s natural for folks to get nervous about uncharted territory in the market. But as we’ve noted a few times recently, new highs on their own don’t mean a crash is imminent.

That brings us to today’s essay. It was first published in the free DailyWealth e-letter from our corporate affiliate Stansberry Research on Monday morning.

In short, like us, our friend and Stansberry Research analyst Sean Michael Cummings believes stocks have more room to run. And even better, the data backs him up…

U.S. stocks recently shot through the ceiling…

On January 19, the S&P 500 Index closed at a new all-time high. Then, the benchmark index moved even higher earlier this week before pulling back slightly.

If you were investing in 2021 and 2022, today’s market environment may feel eerily familiar…

After all, the last market peak was in January 2022 – just after the post-pandemic rally. Over the next 10 months, stocks dropped 25%. Investors suffered the worst annual return since the 2008 financial crisis.

Now, the S&P 500 is back around all-time highs. And it’s happening after a breakneck 2023 bull run.

It may feel like all the money in stocks has already been made. Or worse, it might feel like we’re due for a repeat of the 2022 bear market.

But as I’ll show you today, one indicator disagrees. It shows that now is still a great time to go long – because stocks aren’t done rising yet…

If you want to know where the market is headed, look at utility companies.

These businesses are the bedrock of a functioning society. They keep the heat running, the gas flowing, and the lights on in America.

Utility companies offer services that folks will always need. So they tend to be extremely safe investments in times of uncertainty.

In other words, utilities act as a “risk hedge.” Investors buy up utilities when the future looks rough. Then, they sell these stocks when the coast is clear so they can reinvest the money elsewhere.

We can gauge investors’ risk tolerance by their utility investments…

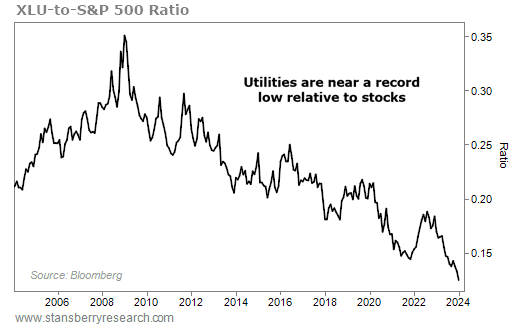

To do this, I recently looked at the price of utilities relative to the price of the S&P 500.

I used the Utilities Select Sector SPDR Fund (XLU), which is an exchange-traded fund that holds a broad basket of utility companies. And I divided XLU’s price by the price of the S&P 500.

The resulting ratio tells us when utility stocks are more popular than other sectors.

When the ratio is high, it means investors are buying utilities and bailing on other parts of the market. And when the ratio is low, it means folks are selling utility stocks in search of riskier rewards elsewhere.

Today, the ratio of XLU to the S&P 500 is around a decade-plus low. Take a look…

You can see the ratio’s spike in 2022 as investor fear took over. But now, XLU has crashed to around its lowest price in years relative to the broader market.

In other words, investors aren’t seeking the safety of utilities today. They expect smooth sailing ahead. So they’re putting cash to work in other areas of the market.

It’s normal to be skeptical when stocks are at all-time highs. That’s especially true when they’re coming off a bad downturn.

But based on the relative weakness in these “safe havens,” momentum is still on the side of the stock market today.

As investors, we don’t want to argue with a clear message like that. Once this ratio turns, we’ll get cautious.

But until then, don’t fight the trend. We want to own stocks today.

Good investing,

Sean Michael Cummings

Editor’s note: Sean and the rest of the DailyWealth team aim to share the world’s best wealth ideas with their readers. These strategies will help you safely – and steadily – build a lifetime of wealth.

Like the Chaikin PowerFeed, this e-letter publishes in the morning every weekday the markets are open. And it’s completely free of charge. You can sign up for it right here.