Almost three years ago, the COVID-19 pandemic crippled the economy…

Public venues shut down and our borders closed to try to prevent the virus from spreading. All the major sports leagues stopped playing. And all types of travel stopped operating.

Folks couldn’t spend on flights, cruises, or other fun activities. So in turn, they hunkered down…

In April 2020, the average American household was saving more than a third of its income. That’s massive. (The government pumping more than $800 billion in “stimulus” checks into people’s pockets also helped.)

Ultimately, as we know, the economy as a whole bounced back from the darkest days of the pandemic. And before long, the stock market once again marched on to record highs.

But over the past year, a huge shift started unfolding…

Surging inflation caused prices to increase rapidly. And in order to keep up, Americans began burning through their savings faster than ever before…

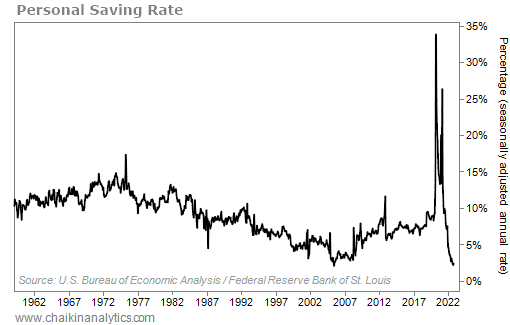

To show you what I mean, let’s look at the “personal saving rate”…

The U.S. Bureau of Economic Analysis calculates this data. And it’s exactly what it sounds like. It’s the percentage of income that an American household is saving at any given time.

Take a look at this chart…

As you can see, the personal saving rate spiked to almost 34% in April 2020. That was easily the highest number since the government started tracking the data in the late 1950s.

But notice what has happened since the worst days of the pandemic. Nearly three years after hitting that record peak… the personal saving rate is about as low as it has ever been.

As I said, folks are now burning through their savings to afford the cost increases brought on by inflation. Just think about it…

How much did you spend on groceries at the beginning of last year? What about now?

When their savings are gone, families will have no choice but to cut back. And if large numbers of folks cut back, it could create a domino effect across the entire economy.

For now, one fragile piece is holding everything together…

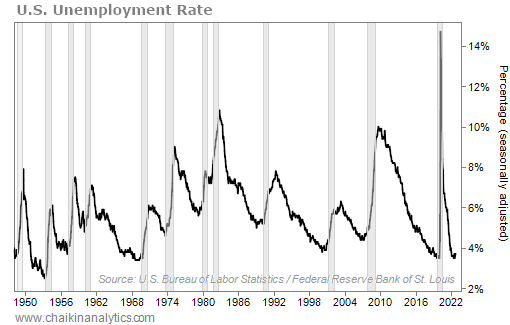

The unemployment rate remains historically low.

You see, most people still have a job. And although things are more expensive than before, money keeps coming into Americans’ bank accounts. So they can still afford to spend.

However, that could all change in the blink of an eye…

The unemployment rate has quickly spiked at various times throughout history. Just take a look at what happened during the COVID-19 pandemic…

Unemployment peaked at the same time Americans were saving more than ever. It surged to nearly 15%.

Many people lost their jobs. But the government’s stimulus kept the economy going.

Here’s the scary part…

Mass layoffs are already starting to happen.

Back in November, reports surfaced that Amazon (AMZN) planned to cut roughly 10,000 jobs. Then, just yesterday, the company said the total number of cuts would be 18,000.

And companies in all types of industries expect to trim positions in the months ahead.

For now, the only thing keeping us out of a recession is low unemployment. But if the mass layoffs continue as we head into the new year, the economy is going to be in bad shape.

And even worse, the government won’t be able to bail us out this time. The inflationary consequences would be too disastrous.

The silver lining of this situation is that surging unemployment causes things to reset…

Folks stop consuming goods and services when they don’t have jobs. Prices fall. Markets bottom out. And then, the markets become fertile and poised for a new bull market.

Also remember that no matter how bad things get, opportunities always exist somewhere.

The Power Gauge will once again prove to be tremendously valuable in helping us uncover those opportunities. It will help us identify the stocks that are poised to outperform.

Even if the overall economy is in shambles, the Power Gauge remains our guiding light.

Good investing,

Marc Gerstein