Believe it or not, dividends were once the primary lure for the stock market as a whole…

American industrialist John D. Rockefeller is purported to have said, “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.”

These days, that type of thinking comes across as quaint. Most investors would rather put their money into high-flying growth stocks. They’re looking for big, quick gains.

As you’ll see today, the reality around dividends is nuanced. In modern history, investors who focus on dividends have done well by some measures and poorly by others.

But right now, this “sleeping giant” is starting to wake up again…

Let’s start with the iShares Select Dividend Fund (DVY)…

DVY debuted on November 7, 2003. It’s the oldest dividend-focused exchange-traded fund (“ETF”) in the market. And since inception, its total return (stock gains plus dividends paid) is more than 360%.

For income seekers, DVY has reigned supreme over bonds in that span. The total return of the iShares IBoxx Investment Grade Corporate Bond Fund (LQD) is only 140% since then.

Of course, investors had many opportunities to beat DVY over the past two decades…

Since DVY’s launch, the total return of the SPDR S&P 500 Fund (SPY) – an ETF that tracks the benchmark S&P 500 Index – is roughly 485%. And the sexier, tech-oriented Invesco QQQ Trust (QQQ) – which tracks the Nasdaq 100 Index – has returned around 1,010%.

However, things recently started to swing in favor of dividend stocks…

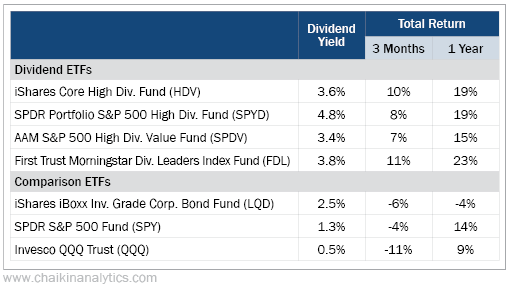

Our Power Gauge system currently ranks 683 U.S. equity ETFs. The table below lists the four largest dividend ETFs with “very bullish” rankings, as well as our comparison ETFs…

These dividend ETFs walloped the market over the past three months…

For example, you could’ve earned 11% from the First Trust Morningstar Dividend Leaders Index Fund (FDL). On the other hand, you could’ve lost roughly 11% in tech stocks with the Invesco QQQ Trust.

It’s that simple.

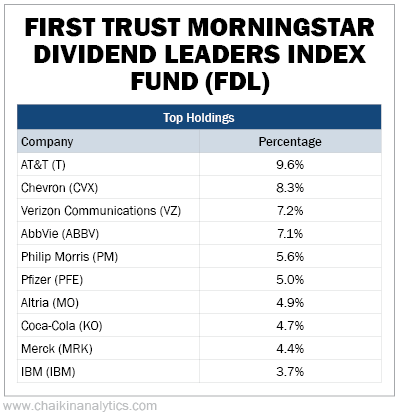

And we’re talking about beating tech stocks with a bask of companies that darn near any investor should want to own. Take a look at FDL’s top 10 holdings…

Folks, the sleeping giant has awakened. Investors are seeking out stability with dividend-paying powerhouses. The reasoning behind this shift is pretty obvious…

Inflation was supposed to be resolved by now. And so were the COVID-19-spurred supply-chain issues. But the waning pandemic hasn’t alleviated either of these pressures.

Now, a military conflict is happening in Europe. And even if it’s resolved tomorrow, the effects will linger…

Russia is the world’s top wheat producer. And Ukraine is in the top five.

The two countries are also responsible for a sizable portion of the world’s nickel and palladium production. Those two metals are extremely important to the car industry.

Nickel is a key component of electric-car batteries. And palladium is essential in catalytic converters for the more traditional, gas-engine cars.

Simply put, the risk profile of the world – and by extension, investing – has changed in recent months. And when growth is uncertain, investors turn back to the basics.

Dividend-paying stocks continue to be the foundation of the market. And current global conditions mean that wise investors are taking notice of these stocks once again.

Now, dividend stocks are outperforming everything from the broad market to bonds to high-flying growth stocks. This isn’t a fluke… The sleeping giant is awake again.

Good investing,

Marc Gerstein