The American consumer is not done consuming… not by a long shot.

Heck, consumer spending in the U.S. just hit another all-time high in the third quarter.

But the thing is, this type of spending can take on many different forms.

And after many months of spending a lot of time and money at home… fixing up their places, growing gardens, taking on new hobbies, and more… folks are ready to get out.

After all, you can only spend so much money on your backyard paradise. You eventually need to entertain yourself in other ways. And Americans are increasingly doing that…

In short, the American public is shifting from “let’s buy something” to “let’s go somewhere.” As a result, after a long COVID-19 break, travel and leisure stocks are compelling again.

I’ve seen this shift happening firsthand, too…

Like many Americans, I recently needed to get out of the house. So I traveled to a few fun destinations. During those trips, I saw incredible demand for these types of services…

Planes were packed to the gills when I visited Las Vegas and Miami in recent weeks. Airport bars didn’t have any empty seats. Huge lines of people snaked through hotel lobbies, waiting to check in. And restaurant reservations were extremely hard to get at normal dining times.

Recent numbers from the travel industry support my observations, too… More than 2.3 million Americans flew during the Thanksgiving holiday. That’s a record for the COVID-19 era. And it’s just about back to the level we were at in 2019.

I’m also willing to bet that this trend will continue despite the recent scare from the COVID-19 Omicron variant. Unless there’s a government-mandated lockdown, people are going to keep pushing to get out of their homes.

With all that in mind, it might seem on the surface like it’s “all systems go” in travel-related stocks. But when you dig a little deeper, you see that’s not exactly true – not yet anyway.

For instance, even though my flights were full, airlines are still facing hurdles these days… American Airlines (AAL) and Southwest Airlines (LUV) both canceled thousands of flights because of staffing problems.

In addition to finding enough folks to come to work, you can add high jet-fuel costs, rising food prices, and increasing salaries and benefits to the list of hurdles for the airlines.

That’s why stock selection is key to enduring success for investors. If you want to consistently make money with stocks, you must have a guiding theme and follow a process.

We have a theme to focus on already – the shift in American consumer spending.

And fortunately for us at Chaikin Analytics, our proprietary “Power Gauge” system provides the process… It evaluates more than 4,000 stocks using 20 different factors.

As Chaikin Analytics CEO Carlton Neel mentioned in the PowerFeed yesterday, the 20 factors in the Power Gauge include everything from insider activity… to analyst rating trend… to earnings growth… to whether the big Wall Street firms are buying or selling.

Today, let’s use the Power Gauge to focus on the developing shift in consumer spending…

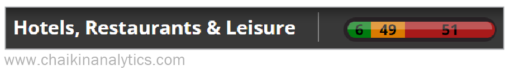

Specifically, we’ll take a closer look at the Hotels, Restaurants, and Leisure industry group. S&P Global Ratings currently tracks more than 100 stocks in this group. And right now, according to the Power Gauge, the outlook is bleak for many of these companies…

The number in green tells us that the Power Gauge only rates six companies in this industry group as “bullish” or better today. Meanwhile, the system is “neutral” (yellow) on 49 companies… And it’s “bearish” or worse on 51 others.

So to me, the takeaway is simple…

People don’t want to be stuck at home anymore. They’re going out into the world and getting back to normal. We’re starting to see this shift play out in real time around the country.

However, that doesn’t mean you’ve missed this part of the “reopening” trade yet…

The Power Gauge tells us that the majority of this industry group is currently rated “neutral” or worse. That means the shift in American consumer behavior is only just beginning.

Remember, as I said earlier, stock selection is key to your investing success. And using our process with the Power Gauge, it’s clear that we should steer clear of most travel-related stocks at the moment.

For now, make sure you watch this industry group closely… The time to buy will come soon.

Good investing,

Pete Carmasino