The Power Gauge made a very contrarian call a few months ago…

You see, in late March, our system flipped to a new “bullish” rating on the S&P 500 Index.

That’s important for one reason…

At the same time, the professional forecasters thought things were as bad as they could get. These economic pros were the most negative they’ve ever been.

Of course, we now know how things worked out. A little more than three months later, the market is soaring. So far this year, the S&P 500 is up roughly 16%.

Now, after hitting their all-time negativity extreme, the professional forecasters are backing off. And if anything, it looks like they’re giving in with a shrug right now.

Today, we’ll take a closer look at this idea. And we’ll see why the Power Gauge was able to outmaneuver the eggheads…

Folks, I built the Power Gauge the way I did for a reason…

Regular readers know it focuses on 20 individual factors. It combines both the financials and the technicals. And in the end, it assigns a “very bullish” to “very bearish” rating on nearly every U.S.-listed stock.

Using its stock ratings, the Power Gauge can also provide ratings for many exchange-traded funds (“ETFs”). That includes broad market ETFs – like the SPDR S&P 500 Fund (SPY).

The Power Gauge will assign a rating for these ETFs regardless of current market sentiment.

That’s exactly what happened when it assigned the S&P 500 a “bullish” rating in late March.

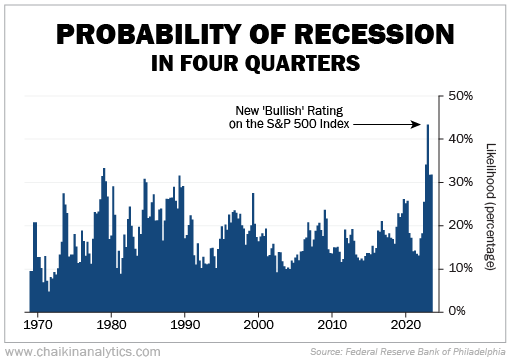

I’ve noted the Power Gauge’s rating change on the following chart. Take a look…

Now, there’s a lot to unpack here. But the basics are simple…

This chart shows us a survey of the eggheads’ “probability of recession in four quarters.”

The survey traces its roots back to the late 1960s. The Federal Reserve Bank of Philadelphia took over the survey in 1990. And as you can see, the professional forecasters’ predicted probability hit its highest level at the start of this year.

The data for this survey comes out once a quarter. And the chart reflects the discreet changes from quarter to quarter.

Most importantly, you can see that the Power Gauge assigned the broad market a “bullish” rating right as professional forecasters’ sentiment reached an all-time extreme this year.

Since then, the market surged higher. And the professional forecasters have backed off…

We’re starting to see what I would describe as “a forecaster’s shrug.” It’s hard to see on the above chart, but the line dips back down on the far-right side after the recent extreme.

Look, the Power Gauge wasn’t trying to be contrarian. It was simply looking at the market-performance data, as well as the 20 factors behind each and every stock it rates.

And its “bullish” flip happened at the right time.

Does that mean we’re guaranteed to avoid the recession the eggheads fear? No. But it does mean the Power Gauge sees a high probability of strong returns in the coming months.

So like always…

I’ll listen to what the academics say. But I’ll follow the Power Gauge with my money.

Good investing,

Marc Chaikin