Editor’s note: The markets and our Chaikin Analytics offices will be closed tomorrow, April 7, for Good Friday. So we won’t publish our Chaikin PowerFeed e-letter. We hope you enjoy the long weekend. And you can expect to receive your next issue on Monday, April 10.

Oil prices are soaring once again…

They jumped more than 6% on Monday. It was the biggest one-day move in more than a year.

The latest surge happened because oil cartel OPEC and its allies announced surprise production cuts over the weekend. And fears of reduced supply caused prices to spike.

Folks, we can’t escape reality…

Oil prices could remain between $80 and $100 per barrel for a long time. And gasoline prices between $3 and $4 per gallon are likely here to stay, too.

Now, you might expect me to say, “Rush out and buy energy stocks!“

After all, regular readers know we’ve been “very bullish” on the energy sector for more than a year. In fact, our first positive mention about these stocks occurred in December 2021.

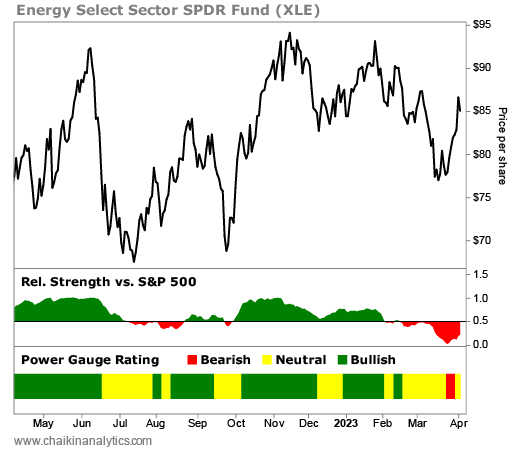

Since then, the Energy Select Sector SPDR Fund (XLE) has crushed the broad market…

XLE is up roughly 50% over that span. And the S&P 500 Index is down around 13%.

But now… things are different.

Despite high energy prices, the Power Gauge is flashing a warning sign for the sector…

XLE is the broad measure of the energy sector. For most of the past year, it held a “bullish” rating in the Power Gauge. And many of its holdings had “bullish” or better marks as well.

Now, the exchange-traded fund (“ETF”) did dip in and out of “neutral” territory. That’s normal. It’s part of how the Power Gauge communicates where a stock or ETF is in its trend.

But today, something different is happening. Take a look at XLE’s one-year chart…

The “something different” is obvious on the chart…

After months of outperformance, XLE is now firmly underperforming the S&P 500. Even worse, the Power Gauge briefly flashed a “bearish” warning on the sector last month.

I’m also looking at the individual ratings of the stocks inside the ETF…

Only one of the 23 holdings with Power Gauge ratings is “bullish” or better. Meanwhile, three holdings are currently “bearish” or worse. And the rest are stuck in “neutral” territory.

Could the energy sector turn around in the near future? Absolutely…

High energy prices and an aggressive posture from OPEC+ will keep things moving. But that doesn’t mean we should rush to buy energy stocks like we’ve done for more than a year…

The energy sector is underperforming the broad market right now. And many of its holdings are in wait-and-see (“neutral”) mode. That will take serious momentum to overcome.

And it’s especially true when other, less defensive sectors are soaring. As we’ve discussed, that’s happening with tech stocks right now.

You’re likely seeing headlines about high energy prices. After all, a 6% move in one day is huge. And we’ll probably need to live with oil prices near $100 per barrel for some time.

But today, the Power Gauge is clear…

Several opportunities in the market earn a “bullish” rating. But energy isn’t one of them.

Don’t let the headlines fool you into thinking otherwise.

Good investing,

Marc Chaikin

P.S. Speaking of opportunities in the market, I recently revealed one of my favorite recommendations today. The Power Gauge rates this tech-related stock as “very bullish.” And for a short time longer, you can get its name and ticker symbol 100% free right here.