Folks, it’s hard to overstate the accomplishments of Bill Gross…

Gross co-founded PIMCO in the early 1970s. And he ran the investment-management firm’s Total Return Fund through 2014. It had more than $293 billion in assets at one point.

But his accomplishments extend beyond just managing a lot of money…

Gross has made a lot of money for investors, too. Investment-research company Morningstar said exactly that in 2010, while naming him “Fund Manager of the Decade”…

No other fund manager made more money for people than Bill Gross.

When folks like Gross make big announcements about the market, it’s wise to pay attention.

After all, today’s market isn’t a one-way ride. Some sectors and subsectors are soaring along with the S&P 500 Index – like technology and financials. But others aren’t…

For example, the SPDR S&P Health Care Equipment Fund (XHE) is down roughly 16% since the beginning of August. It’s a staggering decline for a group of stocks that most folks consider safe to own.

Let’s take a closer look today at the flip side of XHE’s recent performance. We’ll focus on a top-performing subsector. In fact, both Gross and the Power Gauge recently pointed to it…

Regular readers should already know where we’re heading…

After all, on November 8, I detailed how Gross had just made an unusual bet on regional banks. Notably, the Power Gauge had recently spotted the opportunity as well.

Almost six weeks later, we know that it was a great call…

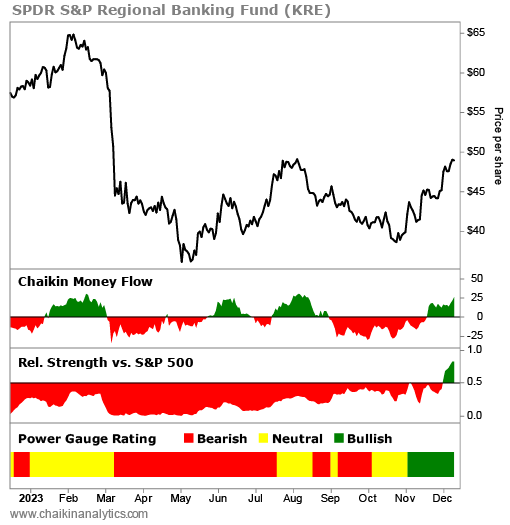

You see, regional banking is now one of the top-performing subsectors. The SPDR S&P Regional Banking Fund (KRE) is up about 25% since early November. Take a look…

Even more important, as I said, the Power Gauge noticed this shift in late October. So any investors who followed the system’s signal are sitting on a solid double-digit gain today.

Folks, this is why I love having the Power Gauge at my side. It makes seeing trend changes like this one easy. And if you know what you’re looking for, you can find consistent winners.

I want to point out a couple key things about KRE’s current setup…

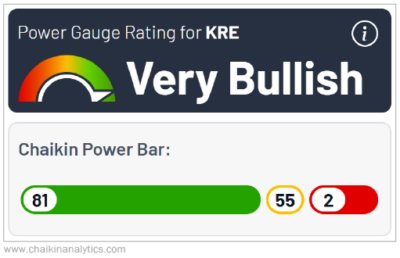

First, the Power Gauge remains “very bullish” on the exchange-traded fund. Second, as you can see in the screenshot below, KRE has an incredibly favorable Power Bar rating as well…

KRE currently holds 81 “bullish” or better stocks. And only two are “bearish” or worse today. That makes it one of the most favorable subsectors we track in the Power Gauge.

Beyond that, our proprietary measure of relative strength has turned higher for KRE. That tells us we’re seeing legitimate market outperformance. And it’s true…

Again, KRE is up about 25% since early November. The S&P 500 is doing well, but it’s only up around 8% in that span.

Finally, something serious is going on with our Chaikin Money Flow indicator…

Chaikin Analytics founder Marc Chaikin developed this indicator in the 1980s. And four decades later, it still helps investors measure what the “smart money” is doing…

Specifically, the Chaikin Money Flow indicator looks at the buying patterns that large institutions typically follow. And in KRE’s case, the smart money is pouring in today.

So folks, I hope you see my point…

Gross announced a big bet in this part of the market in early November. The Power Gauge highlighted the opportunity, too. And right now, the system tells us more upside remains.

I recommend you check it out today.

Good investing,

Vic Lederman