Darryl Rawlings wanted to help pet owners everywhere…

He was working as a software developer at a veterinary clinic in 1999. And in that role, he saw that many owners couldn’t afford the excessive costs to take care of their pets.

So a year later, he launched Trupanion (TRUP).

Trupanion is a pet-insurance company. But it’s different than most of its competitors…

Among other things, the company allows the veterinarian to be paid directly. So pet owners can bypass filing an insurance claim after making a payment.

It’s an attractive business model, too. The company went public in 2014. And it has produced steady revenue growth every year. It’s now pushing $1 billion in total sales.

But the problem is… Trupanion can’t seem to make a profit.

As I’ll explain today, a legendary short seller is now setting his sights on Trupanion. He’s accusing the company of price gouging and more. And the stock is now in free-fall mode.

But if you had the Power Gauge at your side, you could’ve seen all the trouble coming…

Life was good for Trupanion’s investors in the early days of the COVID-19 pandemic…

Everyone was stuck in their homes. Many folks bought pets to keep them company. And related to that, a lot more people acquired pet insurance from companies like Trupanion.

The company’s stock soared from about $24 per share in March 2020 to a peak of more than $155 per share in December 2021. That’s a roughly 550% gain in about 21 months.

But then, the Power Gauge flashed a “steer clear” signal on this stock…

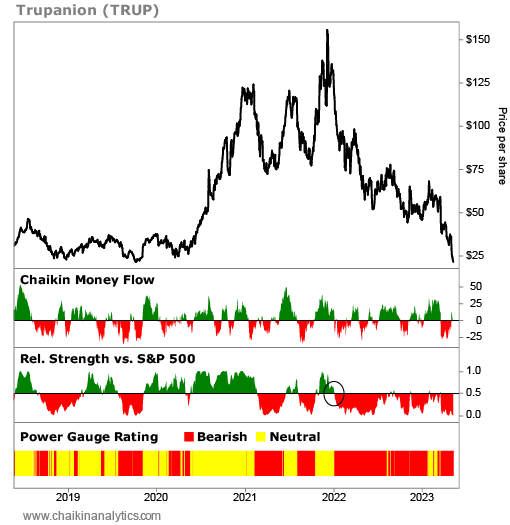

Our one-of-a-kind system was never “bullish” on Trupanion. The fundamentals weren’t strong enough. And in the first week of January 2022… its relative strength went negative.

You can see what I mean in the following chart. I’ve circled the relative-strength change in the lower panel. Take a look…

A negative relative-strength change is a telltale sign of big trouble ahead…

Put simply, it tells us that a stock has gone from outperforming the broad market to underperforming it. That’s a big deal because, on Wall Street, success begets further success. And underperformance sends investors running for the exits.

After all, no one wants to keep holding a position that underperforms the broad market.

And in this case, the company was clearly struggling…

Before the relative-strength change in January 2022, Trupanion missed earnings expectations in five straight quarters. And it has endured four more misses since then.

That’s not good.

Now, well-known short seller Marc Cohodes is taking aim at the company…

Cohodes gained fame for his successful bets against several businesses. For example, his exposé and related short position on mortgage lender NovaStar Financial leading up to the financial crisis is now a Harvard Business School case study.

He’s known for his colorful and blunt language when discussing companies and their executives. He sometimes uses profanity and doesn’t hold back on executives he believes are engaging in unethical behavior. And to put it succinctly… he’s good at what he does.

In a series of Twitter posts last week, Cohodes called Rawlings (Trupanion’s founder) out on what he believes is a toxic work environment. Cohodes also railed on corporate behavior that reeks of price gouging. He cited a 28% rate increase for pet owners in California.

Cohodes’ opinion now lines up with the Power Gauge. He believes folks should avoid Trupanion at all costs.

But here’s the thing…

The Power Gauge alerted investors to the negative relative-strength change in January 2022. That was a clear signal to either sell the stock (if you owned it) or avoid “bottom fishing” with it.

Now, more than a year later, a legendary short seller is calling out the company as well.

It’s further proof that folks shouldn’t get caught up in this stock.

Good investing,

Pete Carmasino