I needed 0.4 seconds to find out why Nvidia (NVDA) is once again in the spotlight…

That’s how long my online search took. And all the results focused on the same topic.

This opening sentence from the Barron’s article sums it up perfectly…

Nvidia is betting big on the buzziest new technology trend: generative AI.

In short, the leading graphics-card designer is working on the “next big thing” in artificial intelligence (“AI”). And it revealed the latest details at its developers conference last week…

Nvidia’s AI Foundations is a set of cloud services that enable users to customize across uses like text, visuals, and even biology. The company’s semiconductors make it all possible.

Some of the world’s biggest tech companies are putting big money into generative AI…

Microsoft (MSFT) has invested more than $11 billion into OpenAI’s industry-leading ChatGPT tool. It wants to bring AI to its Bing search engine to close the gap with Alphabet (GOOGL) in that area. And Alphabet just launched an experimental version of its own AI called Bard.

As I warned last month, it’s way too early to judge how these AI innovations will transform the tech space. But for better or worse, investors want in on AI – and they want in now.

That raises the usual question…

Even if the AI trend explodes, how likely is it to reward folks who buy Nvidia’s stock?

As always, to answer that question, we can turn to the Power Gauge…

Generative AI is sparking a tech revolution…

It allows users to create new images, text, audio, video, and more. And of course, that’s opening up new opportunities for computer artists, poets, music composers, and others.

But for investors, it all comes down to results…

Nvidia’s AI advancements aren’t cheap. And at some point, they need to start paying off for the company.

If they do, shareholders could reap the rewards. If they don’t, shareholders will end up holding an incredibly expensive company.

The Power Gauge reveals this clearly…

We’ll start with valuation.

In the Power Gauge, four out of the 20 factors relate to valuation. They are projected price-to-earnings (P/E) ratio, price-to-sales ratio, free cash flow, and price to book value.

All four valuation-related factors are “very bearish” for Nvidia right now. That tells us the stock is expensive at its current level.

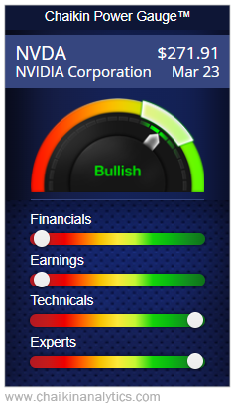

And yet… the Power Gauge is “bullish” overall on Nvidia.

Has the Power Gauge thrown valuation out the window and gone all-in on futurism?

Not at all…

As I said, four of the Power Gauge’s factors relate to valuation. But that’s only one piece of the puzzle. The system includes 16 other factors. Together, they complete the puzzle for us.

Here’s the current breakdown from the Power Gauge for Nvidia…

Now, it might seem like the Power Gauge is all over the place. The top two categories earn “very bearish” ratings. And the bottom two categories earn “very bullish” ratings.

But in reality, this setup makes a lot of sense…

You see, the Financials and Earnings categories involve “observable” factors. That data includes things like 10-K filings, earnings reports, and valuation ratios.

On the other hand, the Technicals and Experts categories reflect “expectations” for a company. That data involves traders’ and experts’ predictions, which are more subjective.

In Nvidia’s case, the positive investment case is moving far away from the “observable” and more toward the “expectations” side. That makes for a riskier-than-usual investment.

Simply put… this is the split reality investors are facing today.

Nvidia’s AI venture comes with incredible promise. But it’s also a high cost against the company’s core financial metrics. And we don’t know whether it will meet expectations.

That hasn’t stopped Nvidia’s stock from soaring. It’s up a staggering 83% so far this year.

So yes, the Power Gauge is “bullish” overall on Nvidia. And as long as the stock continues its upward trajectory, the company will maintain that rating – even if it’s expensive.

Good investing,

Marc Gerstein

Editor’s note: The turmoil in the banking industry has set off a wave of volatility. And it just triggered one of the rarest indicators Wall Street legend Marc Chaikin has ever seen…

It’s signaling what could be the market’s most critical turning point in decades.

During a FREE event tomorrow night at 8 p.m. Eastern time, Marc will reveal the one step you need to take this year to prepare. Plus, everyone who tunes in will also learn the name and ticker symbol of one of his top investment ideas for 2023. Click here for all the details.