No, it’s not the war in the Middle East…

But McDonald’s (MCD) CEO Chris Kempczinski wants you to think that’s the big problem for the fast-food giant.

Along with other big companies, McDonald’s is facing boycotts over accusations of supporting Israel’s war in Gaza. Here’s how Kempczinski put it during the company’s fourth-quarter earnings call earlier this week…

Our outlook is, so long as this conflict, this war is going on, we’re not making any plans, we’re not expecting to see any significant improvement in this.

Kempczinski said that McDonald’s is specifically seeing the “most pronounced impact” in the Middle East. But he also says the company is struggling in other Muslim countries, including Malaysia and Indonesia.

However, as regular Chaikin PowerFeed readers know, the issues at McDonald’s run deeper than that…

Back on December 4, I explained that it would take more than new burger recipes to fix the problems. And I detailed how we could see that using the Power Gauge.

Well, folks, the Power Gauge was right.

McDonald’s continues to be on shaky ground. And if you’ve been there recently, you likely know the key problem…

Now, I want to be clear… I grew up on all-American McDonald’s. I’m not above a fast-food burger.

But something has gone wrong at the chain. And even if you don’t eat there… you’ve probably heard people complaining about the problem.

Last year, a McDonald’s at a rest stop in Connecticut made the news. The franchise was charging nearly $18 for a Big Mac combo meal. That’s the burger, fries, and a soft drink.

Now, the national average price for a Big Mac by itself is actually about $6. And there’s no question that the $18 meal price was on the extreme side.

Still, folks have noticed that the food from McDonald’s is pricy these days – no matter the location. On social media, it’s common to see complaints about it.

If you asked most folks who eat at McDonald’s how they felt, their answer might be something like this…

We don’t go there because the food is good… We go there because it’s “good enough” and cheap. Today, neither of those are true.

This is a dire situation. And it’s one that the company needs to fix quickly.

Kempczinski sees that. In that same earnings call, he also said this…

What you’re going to see is more attention to affordability…

There will be some activity at the local level to make sure we continue to provide value for the lower-income consumer.

He’s not in an enviable position.

Franchises are allowed to set their own pricing. But today, that pricing is driving customers away from the business… even if it’s working out for some owners.

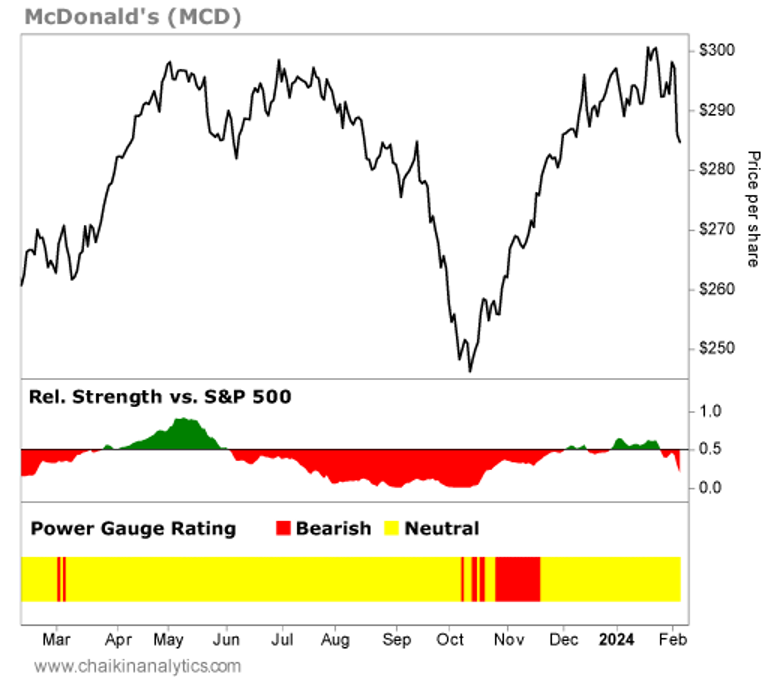

We can also see this battle playing out in the company’s stock price and in the Power Gauge. Take a look…

Since I discussed McDonald’s two months ago, the stock has traded mostly sideways. Meanwhile, the S&P 500 Index is up about 8% over that same time frame.

Put simply, McDonald’s is in the process of trying to solve a major problem.

And it’s no surprise that the company earns a “neutral” rating from the Power Gauge right now. That’s slightly better than the “neutral-” rating it had back in early December, but the Power Gauge is still telling us to be careful.

There are better places to put money to work today than this stock.

Good investing,

Vic Lederman