We’re dealing with high inflation here in the U.S. much like we did in the 1970s.

So naturally, in response, folks are jumping to another common 1970s term…

Stagflation.

You’ve probably seen this topic on the news at some point this year. It’s a mainstream media favorite. But here’s the deal… It’s nothing more than fear-mongering.

Stagflation is a period of high inflation and high unemployment at the same time.

Americans faced stagflation in the 1970s. It was a dark time for our country. And the Federal Reserve struggled to generate policy to solve the problem…

You see, stagflation is a catch-22. It’s hard to fix both issues at the same time. Many of the Fed’s policies aimed at easing inflation tend to make unemployment worse…

Interest-rate hikes make borrowing money more expensive for companies. That makes it harder for businesses to expand. And no expansion means no new workers.

As a result, people have less money to spend. So they buy fewer things, which means businesses don’t make as much, either. And therefore, the businesses need fewer workers.

It’s a vicious cycle.

That sure sounds like where we’re at in the economy right now. But as we’ll discuss, there’s a key difference between today and the 1970s. It has to do with the current labor market…

So far this year, you’ve probably heard that businesses are still struggling to fill open positions. In case you’re not familiar, that’s the definition of a “tight” labor market.

But as the recession ramps up, the narrative in the media is changing…

Instead of showing “help wanted” signs everywhere, the media is reporting more and more about layoffs and hiring freezes. For example, just this week, reports surfaced that tech giant Apple (AAPL) plans to slow hiring and spending to prepare for a potential downturn.

So it might seem like the labor market will soon become less tight. But remember, it’s better to use actual data to guide you rather than what you hear on TV or read online…

Put simply, the data shows we’re still in a tight labor market.

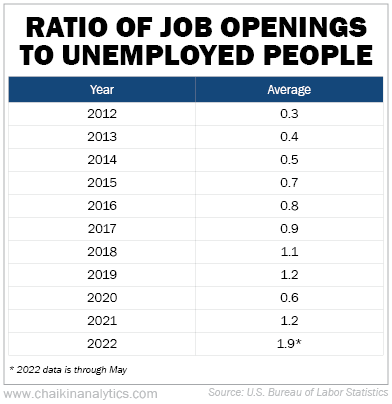

Check out this ratio of job openings to unemployed people over the past 10 years. It’s from the U.S. Bureau of Labor Statistics. Notice that we’re at an unprecedentedly high number…

As you can see, the average for the first five months of 2022 is 1.9.

In other words, there are roughly two job openings for every unemployed person right now. That’s a much higher ratio than at any point over the past decade.

Now, you need to know something else…

In this ratio, “unemployed” doesn’t just mean folks who don’t have a job. It refers to folks who don’t have a job and have been actively looking for one over the past four weeks.

Said another way… this table doesn’t count the people who’ve chosen to just stop looking for standard employment in the aftermath of the COVID-19 pandemic.

Maybe these individuals will decide to enter the workforce again if the economy heads toward a recession. But I wouldn’t count on it… Who wants to “go back to work” in the middle of a recession if they’ve already effectively retired?

The thing is… if they do, given the current ratio, they’ll likely still be able to find jobs.

I’m not saying the future is going to be full of sunshine, rainbows, and roses…

After all, I did say the Fed would throw us into a recession. And it looks like the central bank is well on its way to doing just that.

However, I don’t believe the stagflation the media is shouting about will play out. Right now, the data doesn’t support that idea…

There are about two job openings for every unemployed person who’s actively looking for work. High unemployment isn’t a problem like in the 1970s.

The current U.S. labor market can handle an increase in workers looking for jobs. That could be the needed buffer to avoid high unemployment – and in turn, stagflation.

Good investing,

Karina Kovalcik