The Federal Reserve first hinted at plans to slow its bond-buying program a year ago.

But I’m sure whispers were circulating long before that…

After all, by last April, it had become clear that the COVID-19 pandemic was more than just a health crisis. It was hurting our wallets and pocketbooks, too…

You see, the Consumer Price Index (“CPI”) – one of the U.S. government’s official measures of inflation – has been on a tear since it passed its all-time high in August 2020. That was early in the pandemic. And we’re still in the same boat more than a year and a half later.

It’s hard to avoid the topic these days. Almost everything is more expensive than it was at the start of the pandemic.

The Fed’s announcement that it would start fighting inflation came several months too late. And the central bank’s previous insistence that the inflationary spike was “transitory” quickly became a running joke in financial circles.

But don’t let that fool you into thinking the Fed is powerless. It’s not.

In fact, as we’ll discuss today, the Fed is getting exactly what it asked for. And like it or not, that means its attempt to tackle out-of-control inflation will likely push us into a recession…

When it comes to bond prices, the Fed is king. That’s because the central bank can manipulate the bond market with two major tools in its toolkit…

The first is the Fed’s power to set short-term interest rates. And the second is its ability to buy bonds. We’ll start with the second point…

You see, near the start of the pandemic, the Fed started buying corporate bonds.

Now, the reasoning behind that move is a little in the weeds. You just need to know that it means the Fed set a “price floor” for corporate debt.

Importantly, even though the world was in turmoil at the time, it meant that lending could continue like normal… And it did.

However, as I said earlier, the Fed officially hinted at slowing its bond-buying program in April 2021. And when it begins to taper its bond purchases – or even transition to selling these assets – that starts to drive down prices across the board.

This setup is the same on the interest-rate side of the Fed’s toolkit, too…

If the Fed mentions plans to raise rates, bondholders begin to sell. Even if there are only whispers that the Fed might start thinking that way, the selling begins. That’s because of the inverse relationship between bond prices and yields.

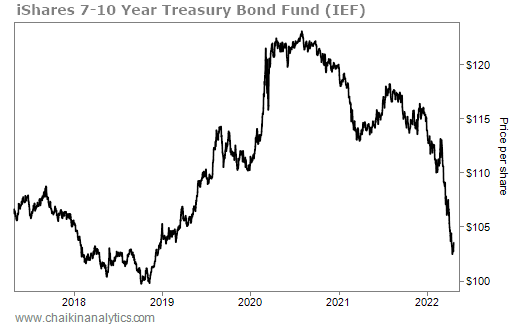

To see what I mean, look at the chart of the iShares 7-10 Year Treasury Bond Fund…

You can see that bond prices plateaued around August 2020, when inflation – in terms of the CPI – hit an all-time high. Some traders must’ve suspected that the Fed would be forced to take action.

The first sell-off happened around that point. Then, the second sell-off occurred when the whispers started circulating in early 2021 that the Fed would soon do something. And finally, you can see a third sell-off happened when the Fed officially hiked rates last month.

In short, it seems the Fed got exactly what it was hoping for… lower bond prices.

And now, as investors, we need to hope the Fed doesn’t overdo its rate hikes or bond-tapering plans – which could send us into a recession. But the Fed has a track record of raising rates before a recession. And it knows what it’s asking for with its actions.

Historically, the pattern is simple…

The economy runs hot. Then, the Fed gets nervous. So it raises rates and ends its bond-buying program to slow the economy. Usually, it raises rates too much… and in turn, the central bank’s actions lead to a recession.

This cycle usually plays out when the economy is on sure footing. That doesn’t seem to be the case today… But Fed Chair Jerome Powell said just a few days ago that “the economy is very strong.”

Folks, through its current actions, the Fed is asking for a recession. The central bank is ending its bond-buying program. And it’s raising interest rates.

Only time will tell if these moves tamp down the massive spike in inflation. But in the end, I wouldn’t bet against the Fed getting what it asks for.

Good investing,

Karina Kovalcik