After a historic rally to begin 2023, stocks cooled off in August…

The S&P 500 Index rose for five straight months from March through July. It was the benchmark index’s longest winning streak since 2021.

And in July, the Dow Jones Industrial Average climbed for 13 straight days. That type of rally hadn’t happened since 1987.

Without question, the market was soaring through the end of July. But it only takes one bad month to shake investors’ confidence. And that’s exactly what happened in August…

The S&P 500 fell roughly 1.8% during the month. And the Dow dropped around 2.4%.

Folks, here at Chaikin Analytics, we’ve been “bullish” on stocks since January. It was hard to take that stance after a brutal 2022. But as you know, the market has been on our side.

The Power Gauge has tracked every inch of the rally, too…

In early February, our one-of-a-kind system flashed “bullish” on the S&P 500 for the first time in several months. And it has solidly held that rating since mid-March.

Yes, the Power Gauge is still “bullish” today. The pullback hasn’t changed that outlook.

Even better, a key market factor is now flashing in our favor as well. As a result, we can expect the good times to resume in the days ahead. So now is not the time to give up…

Put simply, all eyes are on corporate earnings right now. It’s one of the most important factors for the stock market’s long-term performance…

For starters, corporate earnings are key when it comes to determining a stock’s value. And they provide guidance that can be used to project future share-price appreciation as well.

Importantly, this factor is validating our “bullish” stance today…

After months of going the other way, Wall Street analysts are now revising their earnings-per-share (“EPS”) estimates higher. Specifically, they’ve collectively raised their EPS estimates for the third and fourth quarters. And they’ve raised 2024 full-year forecasts, too.

Estimates for third-quarter EPS rose 0.4% from June 30 to August 31. And fourth-quarter EPS estimates increased by 0.6% over the same period.

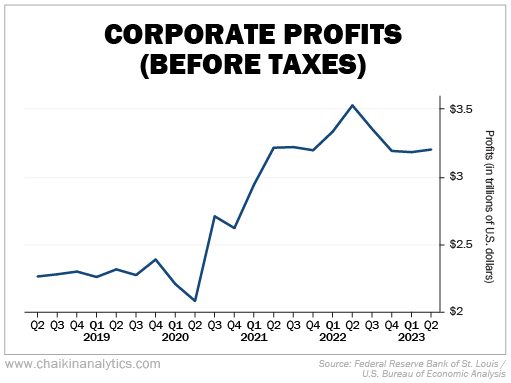

This change is worth watching – especially since corporate earnings are down from their 2022 peak. Take a look…

In short, we’ve been in an “earnings recession” since last year. But Wall Street analysts are finally turning optimistic on corporate earnings moving forward.

Plus, history tells us that November and December are some of the best months for stocks. And with corporate earnings on the rise, we expect good times through the end of 2023.

That’s great news for investors like us, of course.

Turning “bullish” earlier this year wasn’t a popular call. But fortunately, it has panned out well. And now, corporate earnings are turning around.

This key market factor can make a big difference down the line.

So don’t give up after a bad month for stocks. Instead, hold steady and prepare for more gains ahead.

Good investing,

Briton Hill