Being a “data guy” is endlessly frustrating…

On one hand, you constantly hear the mainstream media shout about whatever the narrative of the day is. And on the other hand… you see what the data shows.

More often than I’d like, the data doesn’t align with the narrative of the day.

That’s happening again right now with the labor market…

How many stories have you seen about layoffs?

If you watch the news on TV or check out media outlets on the Internet, it likely feels like everyone is losing their jobs right now. And that’s especially true in the tech sector.

Now, it is true that some big-name companies are laying off employees. Alphabet (GOOGL), Amazon (AMZN), and Microsoft (MSFT) have all cut their workforces in recent months.

But you might be surprised to learn…

We’re near record-low unemployment levels in the U.S. overall. And beyond that, the current number of job openings exceeds the labor force by nearly 5 million.

The data is clear…

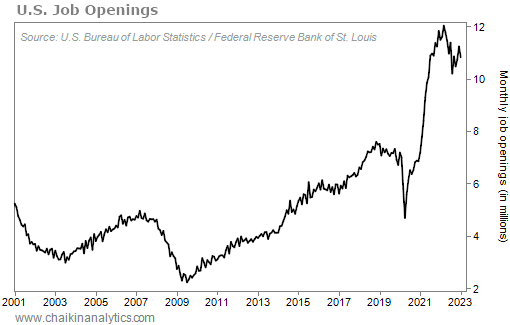

The U.S. economy has an unprecedented number of job openings today. Take a look…

This chart shows the total number of job openings in the country, excluding farm workers. And it involves some specific criteria. Here’s how the Federal Reserve explains it…

Total Nonfarm Job Openings are a measure of all jobs that are not filled on the last business day of the month. A job is considered open if a specific position exists and there is work available for it, the job can be started within 30 days, and there is active recruiting for the position.

As you can see, job openings in the U.S. are near record highs. That’s true even considering the recent round of layoffs that the media is so hyper-fixated on.

And the gap between the current “civilian labor-force level” and the number of job openings is massive, too. As of February, that gap was roughly 4.7 million.

In other words, employers need more employees. But the U.S. labor pool just doesn’t have enough people right now to close the gap.

So here’s what it all means for us as investors…

Put simply, a tight labor market means more growth is ahead. People with jobs buy stuff. And when people compete for jobs, wages go up.

We know that the rate of inflation is slowing. Recent data shows that we’re pulling back from historic highs. But that doesn’t mean the economy is about to shut down overnight…

Sure, we’re hearing from the media about layoffs. And layoffs do lead to slowdowns.

Despite that, the data tells us that the labor market is still tight. And as long as it stays that way, we’ll see continued growth. And the Power Gauge agrees…

Even the tech sector earns a “bullish” rating these days.

In fact, 29 stocks in the Technology Select Sector SPDR Fund (XLK) earn a “bullish” or better rating from the Power Gauge. And only nine stocks earn a “bearish” or worse rating.

That’s way out of line with the message most folks get when they watch the news today. The mainstream media makes it appear like the economy is coming apart at the seams.

But the data is clear…

We’re in the early stages of a recovery. And U.S. employers are still looking for employees.

That’s a recipe for continued growth.

It means now is the time to seek out opportunities, not hunker down and hide our heads.

Good investing,

Marc Chaikin