Jerome Powell is trying to get millions of Americans fired.

And the chairman of the Federal Reserve isn’t shy about it either…

“Labor demand still substantially exceeds the supply of available workers,” Powell said recently in testimony before a Senate committee. That’s Fed speak for “It’s OK if unemployment rises.”

That makes sense. The Fed is still battling inflation. And its main tool, interest-rate hikes, is supposed to squeeze employment numbers.

It’s a little convoluted, but the logic is that higher interest rates raise the costs of business loans. And when businesses’ costs rise, they hire fewer people.

Now, we’ve seen the Fed build this idea into its policy. The Fed has jacked up rates 10 times since March 2022.

But something strange has happened… Inflation is cooling, and jobs remain strong.

Today, let’s take a closer look at that phenomenon… and what it means for the market.

June’s inflation numbers just came out. And the annualized rate is close to 3% now.

That’s not far off from the Fed’s 2% inflation target. Like it or not, the Fed’s rate-hike policy does seem to be working.

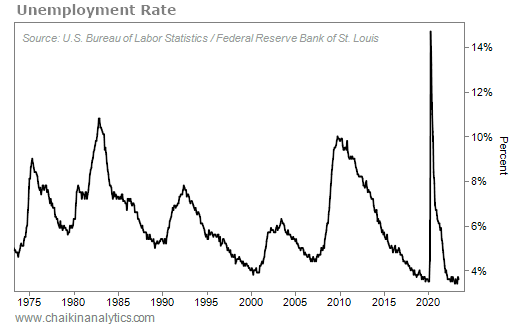

Despite that, unemployment remains near historic lows.

Take a look…

Unemployment today is shockingly close to historic all-time lows. It’s hard to see it on the chart, but it’s just a bit lower than it was in 2000… at the peak of the dot-com boom.

And it’s much lower than it was in 2007… at the peak of the housing boom that led to the great financial crisis.

Sure, the rate of inflation has cooled dramatically. But the employment numbers say the economy is red hot. Powell’s worry is that if employment remains high and the Fed eases off rate hikes, inflation will spring back up like a weed.

So it’s no wonder the Fed is still aggressively targeting inflation. And that’s exactly what Powell has said it will do.

Once again, he uses Fed speak to say he expects “that it will be appropriate to raise interest rates somewhat further by the end of the year” and that “nearly all” Fed policymakers agree on this.

Will this result in higher unemployment? Likely. But you may not notice it. Jobs data show that hiring has slowed compared with the same time last year.

Regardless, the labor market is still tight. Employers are spending more than a month to fill the typical job… That’s important because it means that working Americans still largely have the upper hand.

So, what does all of this mean for us as investors?

It’s easy to play armchair economist. But zooming out, we have some easy takeaways.

The Fed is still on the warpath against inflation. Now, inflation is nearing the Fed’s target range. But the central bank insists it will continue to raise rates this year.

Despite the Fed’s success in tamping down inflation, unemployment remains low.

This means that Americans will continue to do what they do best… drive economic activity forward.

As long as that continues, we’ll continue to have a tailwind behind stocks. That’s what we’ve seen throughout this rate-hike cycle, and it’s what we’re seeing today.

Put simply, the Fed hasn’t crushed the working American yet.

Good investing,

Marc Chaikin