Editor’s note: The Middle East is once again at war…

Islamist militant group Hamas attacked Israel last weekend. Israel quickly responded by declaring war and invading the Hamas-controlled Gaza Strip.

Sadly, many folks have already lost their lives in the latest conflict between the two sides.

At Chaikin Analytics, we view world events like this one through an investing lens. In fact, we’ve already taken a historical look at what war in the Middle East could mean for stocks…

In February 2022, quantitative wizard Karina Kovalcik detailed her findings on what large-scale war means for the markets. Today, we’re sharing an updated version with you…

The world is now experiencing war on two major fronts…

Russia’s invasion of Ukraine started in February 2022. Almost two years later, it’s still going.

Ukraine’s allies continue to send more sophisticated technology to the battlefield, too…

Ukraine will soon receive a batch of M1A2 Abrams tanks from the U.S. Plus, Denmark and the Netherlands are in the process of shipping F-16 fighter jets to the country.

Meanwhile, as Chaikin Analytics founder Marc Chaikin noted yesterday, war broke out in the Middle East once again. Now, the U.S. is also considering sending support to Israel.

There’s no question about it…

The world is full of major military action right now.

But as we’ll discuss today, what the market says about war might surprise you…

In short, throughout history, the market’s reaction to war is different than what you would expect.

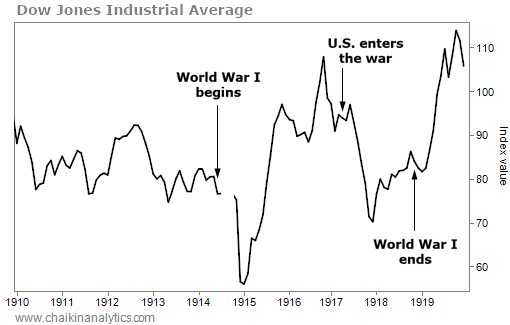

Now, the S&P 500 Index wasn’t around at the time of World War I. So for my analysis, I used the Dow Jones Industrial Average.

The Dow measures the 30 most prominent U.S. businesses of any given period. And it goes back to the late 1800s.

Around the time of World War I, this is what the Dow looked like…

Notice what happened in 1914…

When war broke out, the markets closed for a couple of months. Then, toward the end of that year, they reopened and plunged roughly 30%.

From there, the Dow rose until around when the U.S. entered the war three years later. After that, it went down about 25% before recovering into the end of the war in November 1918.

Here’s the important point…

The Dow experienced a good amount of volatility during World War I. And yet, it ended in 1918 at about the same level as when the war first broke out in 1914.

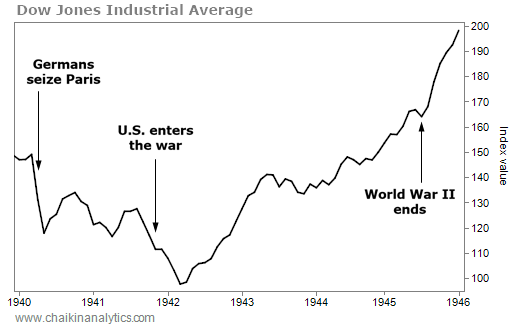

A similar situation played out around World War II in the 1940s. Take a look…

When the Germans took Paris in June 1940, the market plunged about 25%.

And again, the U.S. didn’t officially enter the conflict until it was underway. In this case, as everyone knows, that happened after Japan bombed Pearl Harbor in December 1941.

After that, the market dropped another 10% or so before bottoming in early 1942.

But as you can see in the chart, the Dow soon bounced back. When World War II ended in September 1945, the market was up about 10% from the start of the war.

The market reacted to the Vietnam War along these lines, as well…

While an initial drop in the Dow didn’t occur when the U.S. entered the war in March 1965, it was around 900 at that point. The stock market saw a lot of volatility over the next eight years. But when the U.S. left the country in March 1973, the Dow was still at about 900.

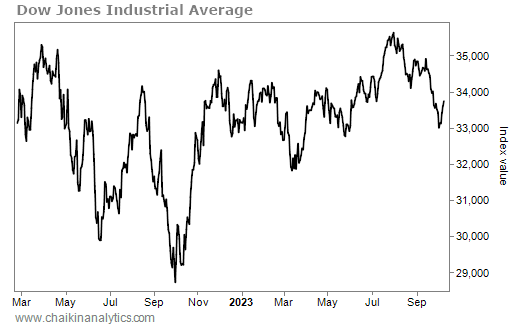

Even today, the market is reacting to the Russia-Ukraine war in a similar way…

The Dow fell about 13% through the end of September 2022. But since then, it has rebounded. It’s now up around 2% since Russia invaded. You can see what I mean in the following chart…

Now, I’m not saying the Russia-Ukraine war is almost over. But it has raged on for almost two years. And yet, the Dow is around the same level as when the war started.

Simply put, the markets interact with war differently than the rest of the world…

Wars are Earth-shattering events. But for the markets… not so much.

Sure, when war breaks out, the stock market often drops. And when the U.S. enters a conflict, it drops again. But by the end of the war, the market tends to even out – or better.

Obviously, no one wants war. But as we’ve learned today, when it comes to your investments, you shouldn’t necessarily fear it.

The fact is simple…

The markets measure the continued growth of humanity. And it’s hard to derail that progress over the long term – even in times of war.

Good investing,

Karina Kovalcik