One of my favorite indicators doesn’t exist in any chart system…

You’ve likely used it in your own lives as well. It’s available to almost everyone.

You see, we all have friends, coworkers, and family members who suddenly get interested in the market’s strongest or weakest sectors. They want to know what’s going on – good or bad.

I’ve seen this indicator at work with the real estate sector recently…

These stocks have gotten crushed over the past year and a half. For example, the Real Estate Select Sector SPDR Fund (XLRE) is down about 30% since late December 2021.

One corner of the real estate sector is suffering the worst – commercial properties.

Of course, I’ve started hearing questions about it from within my network…

What’s the deal with commercial real estate? Do you think prices will turn around soon?

Now, over my decades in the financial industry, my network has grown significantly. I talk regularly with business owners, real estate brokers, mortgage lenders, bankers, and more.

And I’ve learned an important point…

When several people in your network start worrying about a sector, you should pay attention. And if their collective concern happens after a big fall, it tells us…

The bottom is likely close – if it’s not here already.

As you’ll see, that’s the exact situation in commercial real estate today…

Now, I’m not poking fun at anyone who has asked these types of questions. In fact, it’s a legitimate concern…

Commercial real estate includes a wide range of properties. The term can describe office buildings, residential duplexes, apartment complexes, restaurants, and even warehouses.

Many companies in this industry are categorized as real estate investment trusts (“REITs”). They offer different tax advantages and more. But we don’t need to worry about that today.

We just want to know what’s happening in the sector. And as I said, it hasn’t been pretty…

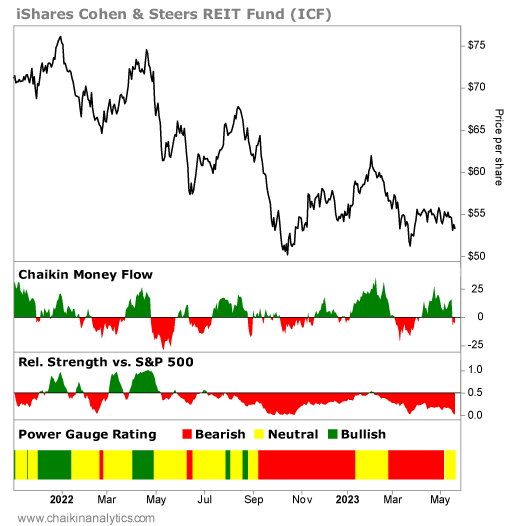

The iShares Cohen & Steers REIT Fund (ICF) is a good way to track the commercial real estate industry. It includes roughly 30 companies in the space – including American Tower (AMT), Crown Castle (CCI), Public Storage (PSA), and Simon Property (SPG).

As I said earlier, the real estate sector has gotten crushed since December 2021…

ICF peaked at about $76 per share that month. And it now trades for around $53.50 per share. That’s a roughly 30% decline in around a year and a half. Take a look…

Now, I admit that this chart doesn’t offer many positives today…

You can see that its relative strength is deep in the red zone. That means it’s performing worse than the S&P 500 Index. And its Power Gauge rating has been “neutral” or “bearish” for most of the past year (with the exception of a couple times last summer).

But I do want to highlight one positive. It relates to the “friends, coworkers, and family members” indicator…

Notice ICF’s low of around $50 per share last October. That’s serving as “support” for the stock right now. And as long as it holds, it means the bottom is already in.

That’s important…

With so many folks in my network wondering about commercial real estate today, it seems like most of the bad news is already priced in. And so far, the chart supports that idea.

However, it’s not time to go all-in on commercial real estate yet…

ICF is still bouncing between “neutral” and “bearish” ratings in the Power Gauge. And the fund’s relative strength remains in the red zone.

For now, we’ll keep it on our watch list. And I suggest you do the same thing.

Good investing,

Pete Carmasino