“Bottom fishing” is the most expensive sport in America…

That’s another name for buying a stock just because its price is lower than it was before.

It might look like a bargain. But in many cases… it’s a trap.

Trying to time the bottom is often a fool’s errand. It just leads to more losses.

Bottom fishing happens more than you think, too…

Wall Street analysts are often forced to make calls on popular stocks that trend lower. And a lot of times, these analysts try to produce some sort of silver lining for investors.

We’ll talk about one of these popular stocks today. As you’ll see, two analysts recently made “bullish” calls on this stock. They’re almost begging investors like you to buy shares.

But from my perspective, they’re dead wrong.

Fortunately, as I’ll explain, you only need one tool to help you avoid these bad calls…

The stock I’m focusing on today is First Solar (FSLR).

You’ve likely heard this name before. It’s a popular stock in the renewable-energy space. Specifically, it makes semiconductors that convert sunlight into electricity.

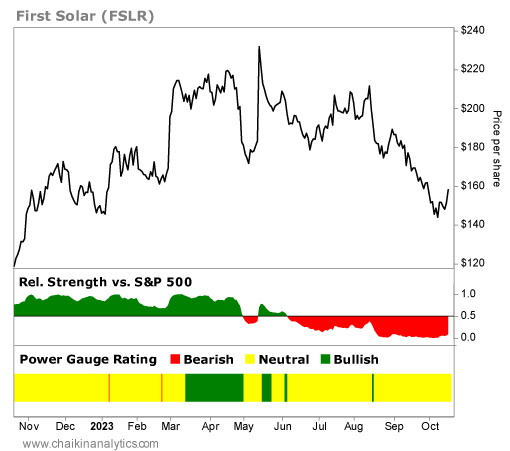

As you can see in the following chart, First Solar is clearly in a downtrend today. The stock has plunged around 31% over the past five months. Take a look…

Notice that our proprietary relative strength indicator for First Solar turned negative in June.

Regular readers know this indicator measures a stock’s performance against the benchmark S&P 500 Index…

When a stock is outperforming the S&P 500, it’s a sign that the trend is on our side. And when a stock underperforms (like First Solar is doing today), it’s a negative setup.

But Wall Street analysts don’t always consider price trends…

For example, on September 23, Bank of America Merrill Lynch analysts called out a buying opportunity in First Solar. They said the stock was “mispriced” based on valuation.

The stock traded for around $162 per share at the time. It was already down around 10% over the previous month.

But Wall Street analysts highlighted a buying opportunity. And a lot of investors likely thought it was time to go bottom fishing.

That would’ve been a big mistake…

First Solar’s stock has continued to fall. It now trades at roughly $158 per share. That’s about 3% below where it was when analysts said the stock was mispriced.

Wall Street analysts aren’t finished trying to bottom fish…

Last week, a Barclays analyst upgraded his outlook on First Solar. He explained that the stock was trading at a discount to its peers in terms of its projected earnings for 2025.

Folks, how can anyone know what 2025 will bring for this stock (or any stock)?

The analyst set his target price at $224 per share. That’s funny to me because the stock peaked at almost $232 per share in May.

But again, price is just a number to some folks.

Our takeaway is simple…

Don’t try to bottom fish – even if Wall Street says you should.

That’s the case with First Solar today. And the Power Gauge helps us avoid this bad call.

Good investing,

Pete Carmasino