Several years ago, Marc Chaikin created a unique way to measure “relative strength”…

It’s a proprietary formula. And at Chaikin Analytics, we don’t give away our secret sauce.

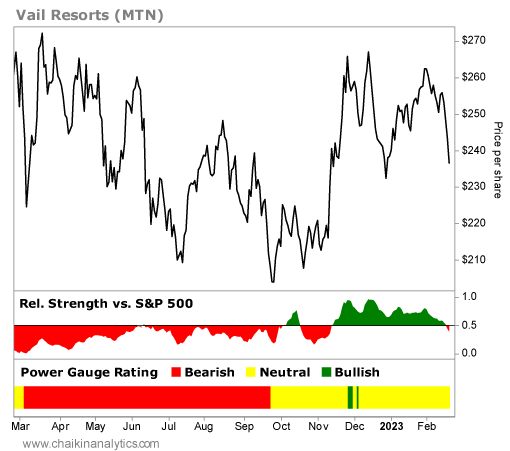

But we clearly display this indicator on all the charts in the Power Gauge. It essentially shows the strength of a stock or exchange-traded fund relative to the S&P 500 Index.

Here in the Chaikin PowerFeed, we’ve spent some time talking about positive relative strength – including yesterday. But relative strength isn’t always positive.

It can signal negative trend changes, too. And if you heed these warnings, it can pay off.

In fact, one negative relative strength signal is clear today…

Ski season is ending.

Let me show you what I mean…

Specifically, we’re looking at ski-resorts operator Vail Resorts (MTN).

In case you didn’t know already, Vail is a beautiful town in Colorado. And the company’s flagship Vail Ski Resort is the third-largest single-mountain ski resort in the U.S.

It’s a “must visit” for local and international travelers alike.

Overall, the company owns more than 10 ski resorts in the U.S., Canada, and Australia. It also owns or manages luxury hotels near its ski resorts, as well as other resort properties.

But the thing is… skiing is a “want” – not a “need” – in most people’s lives. That makes Vail Resorts a consumer-discretionary stock.

Consumer-discretionary stocks have fared well so far this year. For example, the Consumer Discretionary Select Sector SPDR Fund (XLY) is up around 13% in 2023.

However, the Power Gauge is now flashing a warning sign on this company in particular…

More specifically, the above chart for Vail Resorts includes two red flags…

First, the Power Gauge’s overall rating is now “neutral-.” That means the company’s fundamentals are weak, even though the stock is above its long-term trend line today.

Worse still, Vail Resorts’ relative strength just dipped below the line that we use as our directional alert. Look to the far-right side of that lower panel in the above chart.

That means the stock is now struggling to keep pace with the broad market.

Here’s my takeaway…

American consumers are in debt up to their necks.

A recent Federal Reserve report showed that U.S. household debt surged to $17 trillion in the last quarter of 2022. That’s the highest amount ever recorded.

Delinquencies are up as well. For example, mortgage loans considered in “serious delinquency” of 90 days or more have nearly doubled over the previous year.

In short, U.S. consumers have hit their limits. And yet, inflation isn’t going away. Interest rates are still increasing. And the cost of airfare is on the rise, too.

So do you think Vail Resorts’ high-end facilities might see less traffic in the near future?

The Power Gauge is giving us the answer…

In terms of relative strength, Vail Resorts is beginning to sputter out. It just flashed a “bearish” signal. And the Power Gauge’s “neutral-” overall rating is yet another red flag.

The macro environment is challenging, too. So today, it’s best to stay away from this stock.

Good investing,

Pete Carmasino