I never expected to learn a lifelong financial lesson from ugly Christmas sweaters…

Believe it or not, something I watched on Beyond the Tank has stuck with me for years.

In the episode, Robert Herjavec was revisiting what had become one of his most successful investments on the hit NBC show Shark Tank. It was a company called Tipsy Elves.

The company makes what it calls “high end” ugly Christmas sweaters. The sweaters boast garish and cheeky Christmas designs…

For example, one sweater includes holsters for beer cans. Another has flashing lights on a tree and reads, “Get Lit.”

The idea was a hit. The company’s sales soared from roughly $800,000 annually to more than $7.5 million after Herjavec’s investment.

That’s where the lifelong lesson comes in…

In pursuit of growth, the company’s founders then considered introducing a mid-tier product. They figured consumers would want the still nice, but more accessible sweaters.

Herjavec hated it…

Specifically, he told them to stay on the low or high end of pricing. As he explained…

The middle ground gets killed.

His message was simple…

To succeed in business, you need to market products as cheaply as possible or as a luxury option. “Middle ground” pricing doesn’t attract as many consumers.

Now, that may surprise you…

Many people – including plenty of successful businesspeople – assume most consumers are Goldilocks shoppers. They want better quality than the bargain basement implies, but the top-shelf goods are too rich for their blood. So they buy the mid-tier option.

But as it turns out, that’s all wrong. And you don’t have to take my or Herjavec’s word for it.

Just drive to a nearby gas station…

Almost every gas pump has low-, mid-, and high-octane options. And based on human behavior, you might expect that many consumers would go for the mid-tier octane.

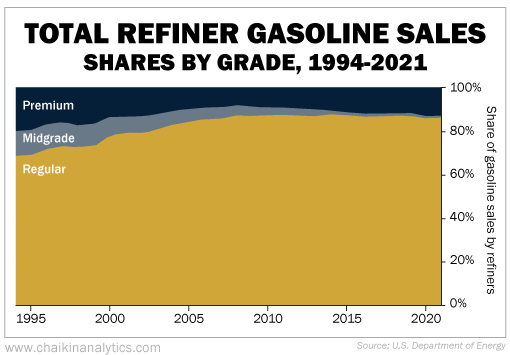

But almost nobody does. Take a look…

Midgrade gas is by far the worst seller. Right now, fewer than 1% of motorists fill up with it. More consumers choose the polar ends of regular and premium gas.

It turns out that shoppers come in two types…

First, we have the budget shoppers. They want to get things done as cheaply as possible. And on the other extreme, we have the luxury shoppers. They’ll spend just about anything to get what they want.

People who can afford it want “high end” items. These consumers naturally associate high cost with “luxury” – even if it’s not always the case.

The market for luxury items is ever-growing. And it should come as no surprise that one of the world’s richest families right now owns a luxury-goods behemoth…

I’m talking about the Arnault family, which owns luxury fashion house LVMH (LVMUY). Their net worth is an astonishing $240 billion.

But what’s even more impressive is how the company has grown over the past two years. LVMH is climbing steadily while the broad market S&P 500 Index is still working to eclipse its 2021 highs.

LVMH previously peaked in August 2021 at around $170 per share. It hit a new all-time high of $199.59 per share just this month. That’s roughly 17% higher than its 2021 high.

So remember, next time you see a seemingly frivolous product come to market…

Nobody buys midgrade gas.

And the “nobody needs that” luxury good might be an investment opportunity in disguise.

Good investing,

Briton Hill