When Craig called his insurance agent, he didn’t know his home was about to burn down…

But it’s a good thing he trusted his gut.

You see, Craig had just bought an electric vehicle (“EV”). And he needed to install a charger at his home.

Incidents of home fires from EV-charging mishaps have made headlines over the years. That was one of Craig’s biggest fears with his new EV.

In reality, EVs are more likely to catch fire on the road after an accident damages the battery. Fortunately, it doesn’t happen with a charger at home as often as Craig thought.

Still, the possibility weighed on Craig’s mind. He and his wife, Cynthia, had just spent $45,000 for new siding. So he wanted to make sure his home-insurance policy was in order.

Craig isn’t alone, of course.

A home is many Americans’ largest asset. Plus, it holds just about everything they own.

The thought of a fire is scary. But the fear of “losing everything” is even worse.

The insurance agent told Craig that his house already had more insurance coverage than needed. And the agent offered to trim down Craig’s policy to lower his required payments.

Fortunately, Craig declined. After all, he had called with safety and protection on his mind. That’s what he wanted. And he stuck to it.

Think about that for a second…

Craig prioritized “peace of mind” over saving a few bucks each year.

Two days after that phone call, Craig’s house burned down in the historic Marshall Fire. In terms of buildings destroyed, it was the most destructive fire in Colorado’s history.

If Craig had reduced his insurance coverage, he would’ve gotten less money after losing everything.

Craig’s story reminds us that nobody can afford to lose everything in a fire. So it’s clear that property and casualty (P&C) insurers play a vital role in our daily lives…

Related to that, they’re a critical part of our financial system. And no matter how things play out in the economy, that won’t change. We’ll keep paying them for peace of mind.

Now, P&C insurers aren’t like banks or regular financial firms. But they’re among the world’s most successful, influential businesses. And it all comes back to one key feature…

P&C insurers have easy access to “almost” free money.

This money doesn’t come from the government or banks, of course. It comes from America’s top businesses, executives, and professionals. Construction companies, doctors, lawyers, financial institutions, and more will all keep paying P&C insurers for peace of mind.

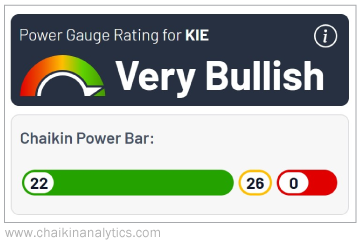

Today, the Power Gauge is “very bullish” on this subsector. In fact, insurance is tied for the top spot out of 21 subsectors. It’s easy to see why when you look at its Power Bar ratio…

The Power Gauge tracks the insurance subsector through the SPDR S&P Insurance Fund (KIE). And as you can see in the above graphic, something incredible is going on…

None of the 48 rated stocks in this exchange-traded fund hold a “bearish” or worse rating today. And the Power Gauge is currently “bullish” or better on 22 of these stocks.

Paid subscribers know I’m intensely focused on this subsector right now. And I recommend that you take a closer look at it as well.

Good investing,

Pete Carmasino