I suffer from a severe case of dialetheism…

You’ve probably never heard that word before. But I bet you know what I’m talking about…

Dialetheism is the belief that a statement can be both true and false at the same time.

My dialetheism relates to a specific part of the stock market…

Small caps.

We’ll cover the details of my dialetheism today. As you’ll see, small-cap stocks haven’t kept pace with the broad market. But fortunately, we have the Power Gauge in our corner…

In short, I love small-cap stocks. But I hate small-cap investing.

My hatred for small-cap investing starts with these stocks’ long-term underperformance…

The broad-market S&P 500 Index is up around 315% over the past 20 years. Meanwhile, the small-cap-focused Russell 2000 Index is only up about 235% over the same period.

The gap is even wider over shorter time frames…

The S&P 500 is up roughly 150% over the past decade, while the Russell 2000 has only gained around 60%. And the two indexes are up about 60% and roughly 15%, respectively, over the past five years.

Many experts suggest this trend will soon change. For the most part, these folks expect more stable interest rates and better business conditions to help the smallest companies.

Of course, I ‘ve heard plenty of analysis like that over the past 20 years.

Maybe the experts are right this time. Maybe they’re not. In the end, it doesn’t matter…

After all, I ‘m a stock picker. So the entire universe of small-cap stocks doesn’t matter as much to me as individual small-cap stocks. We can always find individual opportunities.

But as small-cap stock pickers, we need to overcome two big challenges. If we can’t, we’ll likely never find long-term success in this corner of the market. In short, we need to…

- Avoid the dogs

- Find the potential gems

Now, that might sound like common sense. Avoiding losers and finding winners is a recipe for success in any part of the market.

But with small caps, that’s harder than it seems. This group includes a lot of weak companies. And since they’re small, the penalty for being wrong can hit harder.

One of the biggest questions for small-cap companies is whether they have the means to achieve their growth potential. We can analyze financial statements to find the answer…

In short, financial strength is critical. And the company needs to efficiently use its capital.

Many small-cap companies lose money when they’re trying to grow their businesses. That ‘s not a big problem if they have enough capital to reach profitability (or can raise enough).

But in general, the entire universe of small-cap stocks lags behind in this area…

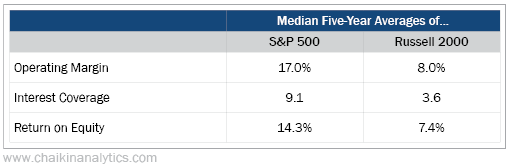

You can see what I mean in the following table. It compares the five-year average operating margin, interest coverage, and return on equity for S&P 500 and Russell 2000 companies…

The companies in the S&P 500 are much better across the board. They’re more cost-efficient. They handle their debt better. And they use their capital more effectively.

Also, keep in mind that the table shows the median numbers. That means half the companies in each group are worse.

In other words, the Russell 2000 includes many bad small-cap companies.

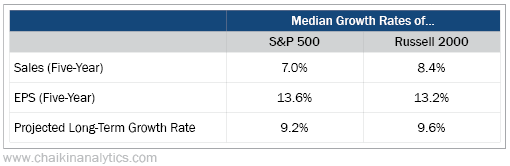

Next, let’s look at the growth rates for all the companies in both indexes…

The S&P 500 doesn’t dominate the metrics in this table as much as the first one. In this case, the median results of the small-cap stocks compare well with the large-cap index.

That tells us we can find great opportunities in small caps if we know where to look. And to help us figure out where to look, we can turn to our one-of-a-kind Power Gauge system…

The Power Gauge excels at separating small-cap winners from losers.

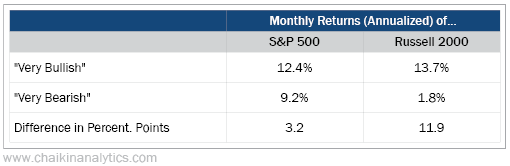

Over the past decade, “very bullish” stocks in the S&P 500 have outperformed “very bearish” stocks by roughly 3.2 percentage points. But in the Russell 2000, the outperformance is almost 12 percentage points. Take a look…

In other words… the Power Gauge is a tremendous edge for small-cap stock pickers like us.

The system steers investors like us away from dumpster-fire companies with poor financial metrics. And it helps us narrow the universe of small-cap stocks down to the likely winners.

That’s the key to overcoming my dialetheism…

I hate small-cap investing. I love small-cap stocks.

And with the Power Gauge, it all makes sense.

Good investing,

Marc Gerstein