Elon Musk is furious…

If you haven’t heard yet, social media giant Meta Platforms (META) just released its competitor to Musk’s Twitter.

It’s a stand-alone app called Threads. And it piggybacks off a user’s existing Instagram account.

That means Meta Platforms founder Mark Zuckerberg can funnel Instagram users into the new app. So more than 500 million daily active accounts could soon make their way to Threads.

For context, Twitter has an estimated 206 million daily active users.

No wonder Musk is worked up about this development. He plans to do everything he can to stop it – including a potential lawsuit.

In a letter to Zuckerberg last week, Musk’s lawyers said…

Twitter has serious concerns that Meta Platforms (“Meta”) has engaged in systematic, willful, and unlawful misappropriation of Twitter’s trade secrets and other intellectual property.

Put simply, Musk thinks that Meta Platforms stole Twitter’s stuff.

Folks, I can’t pretend to be on the cutting edge of social media technology. And the feuds between these two mega personalities are entertaining – if not a little silly.

Still… we’re talking about one of the world’s largest companies.

Meta Platforms’ market cap is roughly $745 billion today. It’s the ninth-most-valuable company in the world.

Let’s use this ongoing circus between Musk and Zuckerberg to take a closer look at Meta Platforms today. As you’ll see, the Power Gauge can lead us to a valuable takeaway…

Folks, I’m sure I don’t need to remind you…

Meta Platforms suffered a colossal wipeout in the recent tech wreck. From its peak in September 2021 to its bottom in November 2022, the stock plunged a staggering 77%.

Now, as the company feuds with Musk, its stock is soaring once again. It’s up roughly 225% from its bottom – including about 141% this year alone.

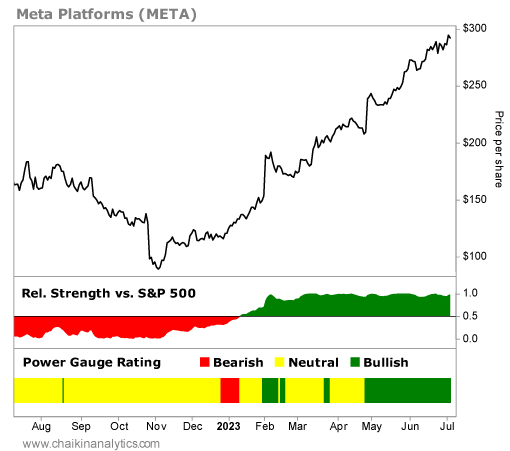

The Power Gauge has tracked Meta Platforms’ incredible surge, too. Take a look…

As you can see in the first bottom panel, our proprietary relative strength indicator turned positive in January. That means Meta Platforms started outperforming the broad market.

Not long after that, the Power Gauge began flashing “bullish” signs on the stock. And you’ll notice that the company has held a “bullish” or better rating since late April.

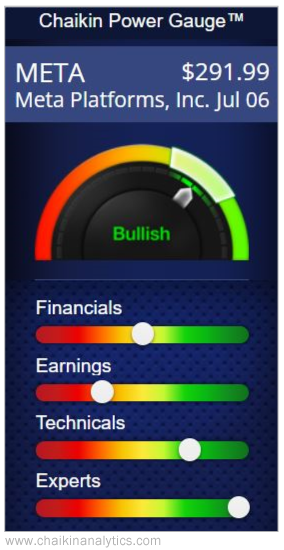

Now, that doesn’t mean Meta Platforms is faultless. You can see in the Power Gauge’s breakdown below that the company struggles in the Financials and Earnings categories…

Despite the weakness in those two categories, the company’s stock is soaring. And thanks to the strength of the other two categories, the Power Gauge is firmly “bullish” overall.

So what does this mean for Threads, Twitter, and the war of personalities? What can investors like us take away from this ongoing circus?

Put simply, Twitter’s lawsuit threat likely won’t derail Meta Platforms’ momentum. And even better, the Power Gauge expects the stock to keep outperforming in the coming months.

Good investing,

Marc Chaikin