Regular Chaikin PowerFeed readers know we’re entering a new bull market…

At the same time, the American consumer is doing better than the mainstream media will ever tell you. And typical “defensive” sectors are performing worse than most of the market.

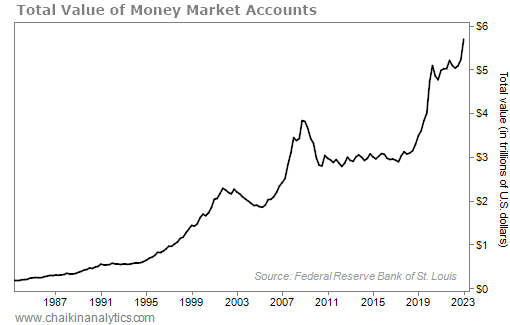

Despite that, investors are piling into cash. They’re holding more cash than ever.

In fact… nearly $5.7 trillion is sitting on the sidelines right now.

That’s right.

This isn’t a squishy “it feels like folks are fearful” type of thing. Using one official indicator, we can see that investors are hoarding cash. They’re still worried about what might come next.

But all the data we have shows that they’re making this move at the worst possible time…

Folks, if you don’t know already, I’m talking about cash holdings in money market accounts.

When an investor sells a stock, the cash usually goes into their money market account. And they can park the cash in the account as long as they want.

The total value of money market accounts ebbs and flows over time.

If the value is dropping, it tells us that mom-and-pop investors aren’t worried. And when it’s soaring, we know that these investors are fearful. They’re choosing to sit on the sidelines.

That’s exactly what we’re seeing today. Take a look…

As you can see, the total value of money market accounts is close to $5.7 trillion right now. And perhaps more significant, the value of these accounts shot up a lot recently.

This trend is important…

You see, the value of money market accounts is what we call a “real-money indicator.” It shows us what everyday investors are doing with their money at any given time.

In other words, we can see how investors are feeling by looking at their actions.

Now, we can expect the value of these money market accounts to gradually grow over time. After all, inflation pushes them higher as more and more money enters circulation.

But in this case, the massive jump on the far-right side of the chart is noteworthy. You’ll notice that the recent move is more extreme (steeper) than most of the past 40 years.

We can also use additional data to confirm this shift…

Specifically, we can look at U.S. equity-fund flows.

This data shows that investors are undoubtedly fleeing stocks – even as the market rallies. For example, U.S. equity funds recently experienced net outflows for eight straight weeks.

This is a particularly dangerous decision for individual investors. History shows us that many of the market’s biggest moves higher happen during a recovery.

That’s exactly what we’re seeing this year…

The broad market continues to climb off its October 2022 lows. The S&P 500 Index is up around 22% since then. And Big Tech, the hardest-hit sector last year, is also soaring again.

And yet, the data shows that investor fear is at an extreme level.

People are waiting for the proverbial “other shoe to drop.” In doing that, they’re ignoring the tremendous market opportunity right in front of their faces.

Folks, I understand playing defense.

But sitting on the sidelines is often a more dangerous financial decision than many folks realize. And a new group of investors is in the process of discovering that today.

Where will they be when they realize they’ve missed the first year of a new bull market?

Don’t fall into that trap.

Good investing,

Briton Hill