Nothing is worse than being too hot at night…

We’ve all experienced it. A hot bedroom can make you toss and turn in bed. It’s hard to sleep when you’re not comfortable.

Fortunately, most Americans don’t need to deal with this problem often…

You see, electric power in the U.S. is generally reliable. Yes, the “grid” is old overall. So outages do happen from time to time. But the outages don’t typically bother us for long.

Of course, the way we got to this reliable power grid rubs some folks the wrong way.

I’m talking about monopolies.

In today’s essay, we’ll cover why monopolies are good for the power industry. And more importantly, we’ll see why right now is an exciting time to invest in these companies…

Overall, Americans don’t like monopolies.

After all, competition drives innovation, fair pricing, and higher-quality products. And a single seller within an industry doesn’t have any incentive to make things better.

But sometimes, the cost to build something is so high that a “natural monopoly” occurs. That’s how the U.S. government saw the utilities market…

A long time ago, the government realized that efficient electric-power delivery would boost economic growth. And the government needed to invest to build out the “electric grid.”

But the government didn’t want to get into the power-generation business. So it turned to utility companies…

These utility companies operate as natural monopolies in many locations around the country. Because of that, they could theoretically charge whatever they want. But in order to keep these businesses from getting out of control, the government regulates them.

In short, the government sets the price that an electric company can charge. The regulated rate is typically the price to generate the power plus a reasonable return on investment.

That’s why most people think investing in utilities is boring. Nobody expects big returns from a company with predetermined profits.

But occasionally, investing in these monopolies is exciting. And right now is one of those times…

As we’ve discussed in recent weeks, the markets are in a rough patch. The S&P 500 Index, our broad measure of stocks, is down about 18% this year. And the tech-heavy Nasdaq Composite Index has fared even worse. It’s down nearly 30% in 2022.

Suddenly, a “reasonable return on investment” sounds great. That’s true even if it’s government-mandated.

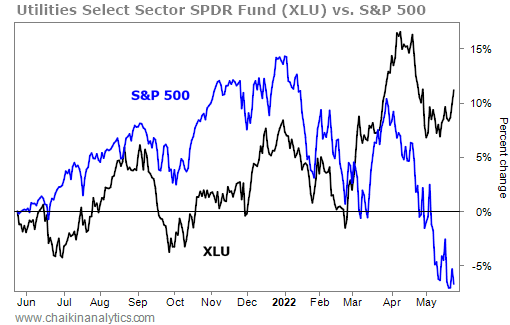

The Utilities Select Sector SPDR Fund (XLU) is dramatically outperforming the broad market over the past year. It’s up more than 10% over that span, while the S&P 500 is down around 7%. Check it out…

XLU includes many of the biggest utility companies in the U.S. It’s a “one click” way to buy into some of America’s largest government-mandated monopolies – like Consolidated Edison (ED), American Electric Power (AEP), and Exelon (EXC).

Better yet, the Power Gauge is currently “very bullish” on XLU…

It’s one of the highest-rated exchange-traded funds in our system today. The Power Gauge rates 16 companies within the exchange-traded fund as either “bullish” or “very bullish” today. And it’s only “bearish” on one of XLU’s nearly 30 holdings.

To sleep well at night in this market, you need a little more than a cool bedroom. Consider adding some stability to your portfolio with these regulated utilities today.

Good investing,

Carlton Neel