Editor’s note: Roughly 11 months ago, Chaikin Analytics founder Marc Chaikin recommended a “boring” company to his Power Gauge Report subscribers – a bank.

Since then, that stock has soared nearly 70%. And we’re still in the position in Power Gauge Report.

Today, we’re sharing a slice of the story that Power Gauge Report subscribers received. As you’ll see, this “boring” bank had an incredible story behind it. And we’re thrilled that our one-of-a-kind Power Gauge helped us spot the opportunity. It proves that our system can find stocks where you might not expect to see big gains like this.

So here’s an adapted version of just one piece of the report that led to a nearly 70% gain in 11 months…

Hackers attacked the Industrial and Commercial Bank of China (“ICBC”) last November…

And because of our interconnected world, it nearly took down the global financial system.

Specifically, the hackers targeted ICBC’s U.S.-based broker-dealer. They took control of the broker-dealer’s systems – including employees’ corporate e-mail accounts.

Most importantly, the hackers’ actions required freezing ICBC’s trading in U.S. Treasurys.

That’s where the stock I recommended to Power Gauge Report subscribers joins the story…

Bank of New York Mellon (BK) acts as a middleman for ICBC’s transactions. And as soon as the U.S.-based bank became aware of the hack, it did what it had to…

It unplugged ICBC’s New York brokerage from the U.S. financial system.

That might not sound like a huge deal to you. After all, who cares if some Chinese bank gets disconnected from the U.S.?

Well, when the Chinese bank trades U.S. Treasurys, just about everyone should care. In fact, if the trading of U.S. Treasurys is halted, it could lead to a massive wave of defaults.

The reason is simple…

U.S. Treasurys are one of the main ways that companies and governments around the world store assets. They’re considered “risk free” because they’re “backed by the full faith and credit of the U.S. government.” And the U.S. government has never defaulted on its debt.

So when hackers attacked ICBC’s broker-dealer, the world’s debt markets rested on Bank of New York Mellon’s shoulders. And the bank did what was needed to carry the load…

In short, it kept things moving smoothly.

It manually cleared ICBC’s trades. And in the process, it effectively loaned billions of dollars to ICBC.

By Wall Street standards, the amount of money involved was small…

The ICBC only owed Bank of New York Mellon around $9 billion. That’s a fraction of the $23 trillion U.S. Treasury market.

But it’s still a huge sum. And if Bank of New York Mellon fumbled when the hackers struck, it could’ve been the first domino that caused the whole global financial system to collapse.

So at least in that moment, the world needed Bank of New York Mellon. And it delivered.

So Bank of New York Mellon’s role as a shining light in the banking sector today should come as no surprise. It’s now the custodian for a staggering $50 trillion in assets.

Yes… trillion.

That’s the most assets under custody or administration in the world.

These days, Bank of New York Mellon manages and services the investments of institutions and high-net-worth individuals…

These power players include pension plans, Fortune 500 companies, endowment funds, and insurance companies. And as we learned during last November’s hack, this list also includes banks like ICBC.

Put simply, Bank of New York Mellon is the investment manager for the financial world’s largest players. And yet, at the time of my Power Gauge Report recommendation in November, its stock was valued at a little bit less than its assets at the time…

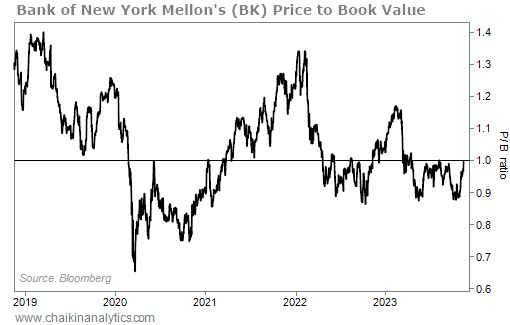

Back then, Bank of New York Mellon traded at a price-to-book (P/B) ratio of around 0.99. That means the market placed no premium on the company’s assets.

Anything under the horizontal line on the chart means the value of the stock is less than the value of the bank’s assets. And nearly all businesses’ assets command some sort of market premium.

So at the time, I explained to Power Gauge Report subscribers that history told us that the bank could easily trade at a P/B ratio as high as 1.3. That’s where the stock found a peak in early 2022.

As we know now, the trade worked out perfectly. Bank of New York Mellon soared. And Power Gauge Report subscribers who followed my advice to buy shares are sitting on a huge gain of nearly 70%.

I’m thrilled to have been able to share it with them. And I hope you’ve enjoyed this peek behind the curtain.

Remember, even “boring” stocks can produce huge returns under the right conditions. And I’ll be using the Power Gauge to help me spot them.

Good investing,

Marc Chaikin

P.S. In fact, I just used our system to spot the next opportunity for my Power Gauge Report subscribers…

The latest issue published yesterday evening. And in it, I explained how the Power Gauge says it’s time to buy shares of one of the best suppliers of home- and office-security products in the U.S.

This company’s stock is in a clear uptrend. It’s showing strong relative strength versus the broad market. And the Power Gauge sees more upside ahead.

If you aren’t already a Power Gauge Report subscriber, find out how to gain access to this brand-new recommendation by clicking here.