Perhaps you read the Chaikin PowerFeed on our website every morning…

That makes sense. After all, that’s why we keep a full archive.

But if you don’t know already, we also send the PowerFeed by e-mail. And if you’re one of the folks who hasn’t signed up to get these e-mails, you’re missing out on a key feature…

You see, the bottom of every PowerFeed e-mail includes a snapshot from the Power Gauge.

It’s a treasure trove of data. And like the PowerFeed itself, it doesn’t cost you a penny.

Honestly, I sometimes wonder whether we’re giving away too much in these e-mails.

The Power Gauge data in every e-mail includes a Market View section. In this space, you’ll see the breakdown of “bullish” and “bearish” stocks across all the broad market indexes.

Every e-mail also includes a Sector Tracker and an Industry Focus section. Those two sections can help you figure out the strongest and weakest industries at any given time.

That brings us to the next section…

Last week, I sent an e-mail to my team about this particular section. I wanted to call their attention to an important development. And now, I’d like to highlight it for you…

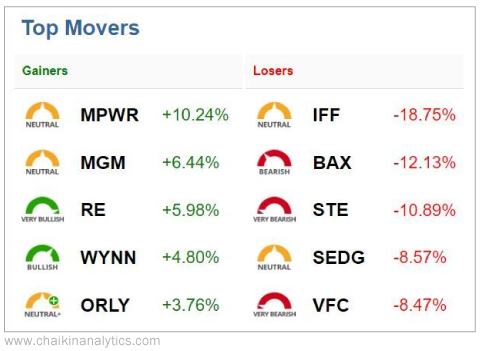

I’m talking about the Top Movers section.

In short, it displays the market’s biggest gainers and losers from the previous trading day.

Now, you can find the best- and worst-performing stocks almost anywhere on the Internet. That’s not the special part. Rather, our breakdown is better than others for one reason…

We provide the overall Power Gauge rating for each of these stocks. And we do it for free.

Here’s what it looks like. I bet you’ll see why I wanted to call it to my team’s attention…

Do you see what I’m talking about? If not, it’s simple…

The top five gainers don’t include any “bearish” stocks. And the top five losers don’t include any “bullish” ones.

Folks, this doesn’t happen every day. But it happens enough for it to not be an accident.

And the thing is… I expect these types of results.

After all, I developed the Power Gauge. It’s the culmination of my life’s work. And the 20 factors tracked in the system combine to produce a reliable overall rating for each stock.

In other words, the “bullish” and “very bullish” stocks will outperform the “bearish” and “very bearish” stocks more often than not. That’s the power of this one-of-a-kind system.

So it’s no surprise when the top gainers don’t include any “bearish” stocks and the top losers don’t include any “bullish” stocks. It’s precisely how I’ve designed the Power Gauge.

And that’s why I’m calling your attention to this development today…

If you already get the PowerFeed e-mails, that’s great. After reading the featured essay every day, I encourage you to look through the Power Gauge data at the bottom.

But if you haven’t yet signed up for the e-mail, you can do that right here. It’s an easy way to access more “behind the curtain” peeks at the Power Gauge. And it’s absolutely free.

In today’s rapidly evolving market, a “bullish” rating can be just what you need to find the next opportunity to pursue. And the PowerFeed can help you get there.

Good investing,

Marc Chaikin

P.S. We recently teamed up with our corporate affiliate Altimetry to make our research even more valuable for investors like you…

In short, by combining the Power Gauge and Altimetry’s rigorous Uniform Accounting standards, we came up with an entire model portfolio of opportunities. They’re so powerful that they can only be called one thing…

Perfect Stocks.

Right now, you can claim access to the full portfolio of Perfect Stocks at a steep discount. Plus, you’ll get our list of 10 popular “Toxic Waste” stocks. Click here to get started.