We’ve all seen how things can go off the rails when the government steps in…

During the COVID-19 pandemic, that’s exactly what happened in the health care space.

Specifically, in March 2020, Congress passed the Families First Coronavirus Response Act. This stimulus package was designed to help during one of the toughest times in our history.

Through this law, the federal government basically gave out continuous Medicaid coverage. Importantly, individuals didn’t need to be evaluated for coverage at the state level.

In other words… people didn’t need to qualify.

Now, let’s fast-forward to earlier this year…

You see, the federal government subsidized the continuous enrollment provision and related programs under an emergency authority. And that authority ended on March 31.

The states are now taking over the Medicaid coverage. But there’s a problem…

Not everyone qualifies under the state’s guidelines.

As you might imagine, this process is creating a huge mess in many states. In turn, it has also created a huge mess for the insurance industry…

Insurance companies that focus on Medicaid lost millions of customers overnight. And relatedly, their stocks tumbled.

But on the flip side, the insurance industry is now full of opportunities for new customers…

Remember, Uncle Sam was offering blanket coverage in the past. Now, individuals need to qualify for insurance. And many of them are heading back to the private-insurance markets.

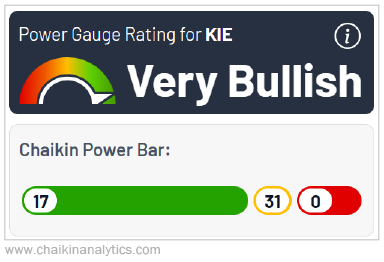

Today, insurance is one of the market’s few bright spots. In fact, only three subsectors in the market currently earn a “bullish” or better rating in the Power Gauge…

Two of these subsectors relate to oil and gas. The third is the insurance industry. Specifically, I’m talking about the SPDR S&P Insurance Fund (KIE). Take a look…

Notice that KIE currently features zero “bearish” or worse stocks.

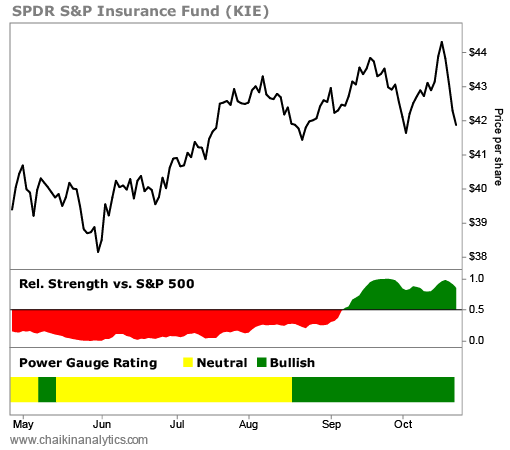

Folks, in today’s volatile market, that’s incredible. And when we use the Power Gauge to look closer at KIE’s chart, the story gets even better. Take a look…

I want you to focus on a couple of things in this chart…

First, you can see that KIE is up about 8% over the past six months. That’s better than the S&P 500 Index’s roughly 3% gain in that span.

Next, look at the dramatic shift in the bottom panel for relative strength…

At Chaikin Analytics, we use a proprietary formula to measure an asset’s relative strength. And in the end, it helps us answer a simple-but-critical question…

Is the asset we’re looking at outperforming the broad market?

In KIE’s case, we see a dramatic change. The exchange-traded fund underperformed the S&P 500 for a lot of the past six months. But since early September, it’s beating the market.

Folks, our takeaway is clear…

Not much is working in today’s market. So we want to pay attention when a subsector with a “bullish” or better grade starts outperforming the broad market.

That’s the case with KIE today.

With the Power Gauge’s help, I’ll keep a close eye on the insurance industry. And I’ll use our system to dig deeper into the 17 “bullish” or better holdings in this fund as well.

I recommend you do the same.

Good investing,

Pete Carmasino