Charles Schwab (SCHW) recently fired a warning shot…

The financial-services giant’s stock is down about 30% over the past three weeks.

Thanks to the recent banking crisis, investors are worried about Charles Schwab’s future…

They fear that the company’s banking subsidiary will shrink faster than it can raise money. But management insists the business can survive even if many customers jump ship.

Headlines and sentiment aside, financial companies pose a special challenge…

Even if you’re well versed in financial statements, you should try to study a bank’s 10-K form. I bet you’ll find that the information is nearly impossible to decipher.

Most investors will feel overwhelmed and uncertain. And today, they’re wondering how many other firms will face the kinds of losses that doomed Silicon Valley Bank.

All hope is not lost on the financial sector, though…

As I’ll explain today, we can sift through the carnage and find potential investment opportunities in this space. We just need to take our cues from the Power Gauge…

Publicly traded companies exist on a spectrum. Some are much easier to make sense of than others…

Homebuilders are at the “easy” end of the spectrum.

Even junior analysts can readily trace the path from mortgage rates to revenue. It’s relatively easy to look beyond the noise to see what’s coming down the road.

Financial stocks are at the opposite end of the spectrum…

These companies disclose a lot of information. And as I said, it’s usually hard to interpret.

This “analytics nightmare” can play a role in how we approach financial stocks. That’s especially true in uncertain times like right now.

On top of that, we need to consider a wide variety of financial businesses…

Like banks, all types of financial companies invest in the markets. Many of them also experienced losses on bonds during the recent crisis. But they differ in how quickly they might need to raise cash to cover customer withdrawals…

We all know that banks have many demand deposits that can bolt in the blink of an eye.

On the other hand, a brokerage firm’s customers probably won’t go elsewhere just because another company offers a higher rate on cash holdings. These customers also focus on commissions, platform capabilities, product offerings, and more.

And even though they’re technically in the financial-services industry, an insurance company’s outflows are usually more visible. Insurers benefit from their robust actuarial models and historical data.

Like other industries, there’s also a lot of room for unique company traits in the financial space. And given the complexities of finance…

Most investors can’t identify the riskiest businesses on their own.

Fortunately, we can turn to the Power Gauge for guidance…

This 20-factor system processes all of the data for us. It uses that information to rate stocks and exchange-traded funds (“ETFs”) as “bullish,” “neutral,” or “bearish.”

Lately, the Power Gauge shows us that bank failures have hit individual companies hard. To mitigate that impact, we recommend focusing on financial ETFs instead of specific stocks…

These financial ETFs contain a variety of holdings. So they protect us in the most classic way – diversification.

The Power Gauge analyzes its own ratings of all the holdings in an ETF’s portfolio. From those grades, it determines an overall rating for the ETF.

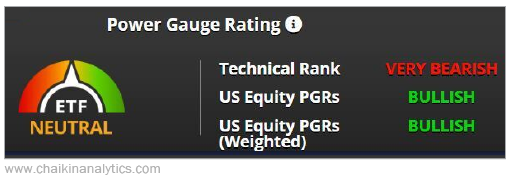

It also adds the “Technical Rank.” This metric ranks the technical strength of an ETF relative to other U.S.-listed funds.

The Experts and Technicals categories of the ETF holdings’ Power Gauge rankings offer a lot of “market wisdom.” These two categories reflect the actions of folks who can – and do – tackle the analytics challenges in the financial industry.

So we consider financial-related ETFs with “bullish” or “very bullish” Power Gauge ratings to be less risky.

“Neutral” or “neutral+” ETFs might be acceptable if none of their component ratings are “bearish” or “very bearish.” (These components include Technical Rank and the Power Gauge ratings of their U.S.-based holdings.)

Let’s look at the SPDR S&P Capital Markets Fund (KCE). This ETF earns a “neutral+” overall rating. Take a look…

And as you can see, all of KCE’s component factors are either “neutral” or “bullish.” As a result, we might consider this ETF to be a respectable investment opportunity today.

But the SPDR S&P Insurance Fund (KIE) is a different story. Take a look…

This fund has a “neutral” overall rating. But based on the weight of its “very bearish” Technical Rank, investors should avoid KIE for now.

As you can see, ETFs aren’t always clear winners.

Today, the Power Gauge doesn’t give “bullish” or better rankings to any ETFs in the financial sector. And KCE is the only “neutral+” ETF with an acceptable Technical Rank.

Even during bad times, we can find potentially good opportunities. But today, that’s hard to do in the financial sector.

So it’s OK to avoid most of this space until things return to normal.

Good investing,

Marc Gerstein

Editor’s note: Did you miss last night’s emergency broadcast? If so, you’re in luck…

In short, Chaikin Analytics founder Marc Chaikin detailed what to expect in the next phase of the banking crisis. He talked about what it means for your money in 2023. And finally, he revealed the perfect investing strategy for today’s volatile market – one that could help you target gains of 100% to more than 1,000% a dozen times or more over the next year.

At least today, you can still watch the full replay. And just for tuning in, you’ll get the name and ticker of one of Marc’s favorite stocks to act on today. The last time he gave away a free recommendation like this, it soared 58% in only four months. Click here to tune in now.