Warren Buffett may be 93 years old… but that doesn’t mean the investing legend is done making big moves.

His business, Berkshire Hathaway (BRK-B), has been on a secret buying spree. In fact, it accumulated about $6.7 billion of a single company.

Amazingly, Berkshire managed to keep the purchases secret for nearly nine months. Or, at least it thought it did…

You see, it looks like the Power Gauge spotted this activity.

Today, I’ll explain how our one-of-a-kind system saw that something big was going on. I’ll also share how you can use the tool to find similar opportunities.

If you haven’t seen it all over the financial media already, the “mystery” company Berkshire has been building a position in is Chubb (CB). It’s a Zurich-based property and casualty (P&C) insurer.

And in recent months, Buffett and his team loaded up on shares. Berkshire bought nearly 26 million shares of Chubb.

That translates to a roughly $6.7 billion position. And as of the end of March, that makes Chubb the ninth-largest holding in Berkshire’s equity portfolio.

This is huge. And Berkshire kept it secret as long as it could.

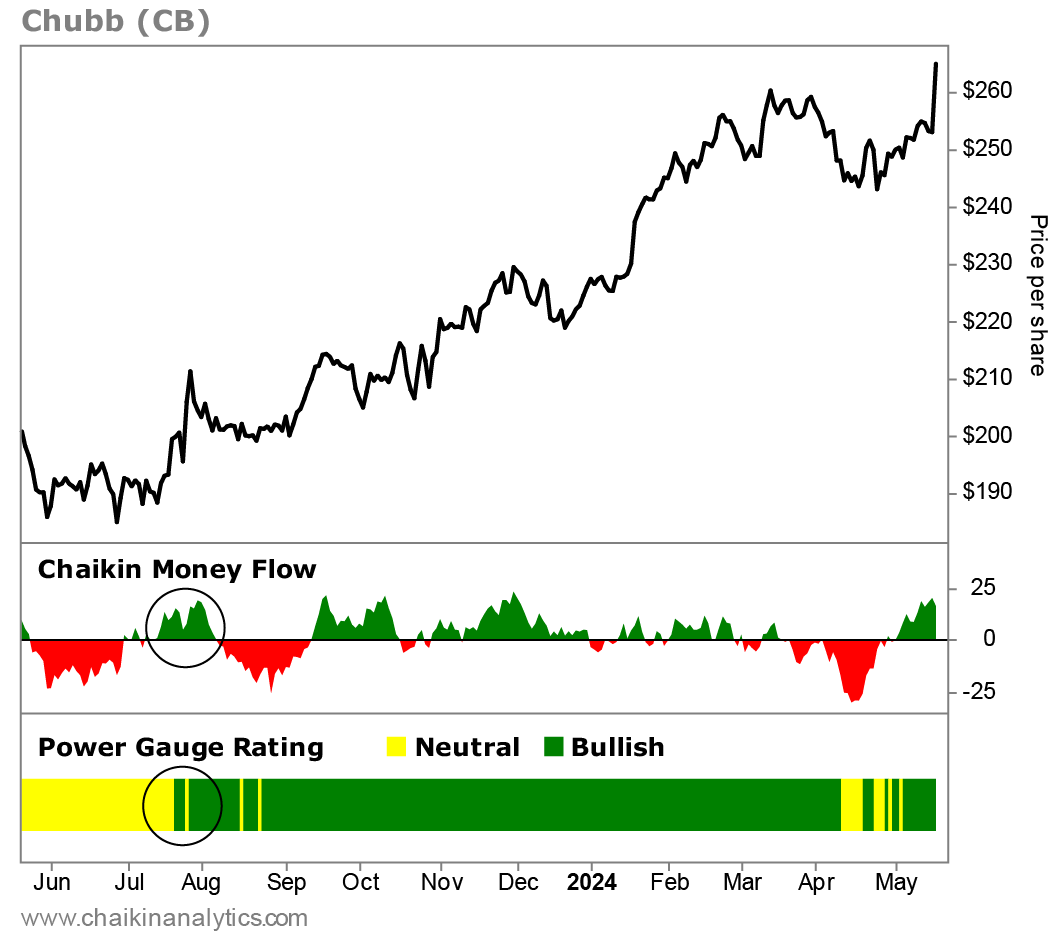

The incredible thing is we can see the changes on the chart. Here’s a one-year price chart of Chubb with additional data from the Power Gauge in the two panels below:

Now, there are a few things going on here. But they illustrate what makes the Power Gauge so incredible…

First up, I want to draw your attention to the Power Gauge rating. You’ll notice that Chubb earned a “neutral” rating in the first half of July. Then, it turned “bullish.”

You’ll also notice that the Chaikin Money Flow indicator spiked around the same time. This indicator is important, so let me explain in more detail how it works…

You see, Marc Chaikin developed the Chaikin Money Flow indicator in the early 1980s as a way to measure the accumulation (buying pressure) versus the distribution (selling pressure) of a stock over time.

The Chaikin Money Flow is displayed as a green-red oscillator. It ranges from +100 to -100. Green represents net buying pressure, and red represents net selling pressure.

Because of the way the calculation was designed, money-flow persistency (significant regions of green or red over a six- to nine-month period) can be a sign of accumulation or distribution by major institutions that have a disproportionate effect on future price movement.

In more simple terms, the Chaikin Money Flow indicator helps us identify the behavior of large institutional investors – such as pension funds, mutual funds, and hedge funds – without directly tracking their order flow.

That’s because large institutions are disproportionately responsible for a “closing effect” on price.

To understand why, envision the behavior of a traditional fund-management company…

The research department determines the firm’s overall orientation on specific stocks, decides which opportunities to be long or short, and figures out the rough proportions.

Portfolio managers make allocation decisions for specific funds or portfolios. They send instructions to a trading desk. The trading desk manages specific buy and sell orders to minimize market impact.

Early in a trading session, traders will be less likely to expose large blocks of shares to trade, which can move the market against them.

But as the session nears its close, traders need to be more aggressive in getting their orders filled, bidding stocks higher if they’re buying, or accepting lower offers if they’re selling.

This is a subtle but noticeable “closing effect” that’s more present than with retail order flow.

The Chaikin Money Flow indicator measures this closing effect. And it helps indicate the “true” buying and selling pressure of the institutions that move markets most.

Folks, this is an incredible tool you can use to your advantage. And with Chubb, it just so happened that the Power Gauge spotted Berkshire’s “smart-money accumulation.”

Again, our system turned “bullish” on Chubb as the Chaikin Money Flow indicator was turning much higher. It’s a powerful combination.

Put simply, when the Power Gauge spots a big change in a stock… you want to pay attention.

Good investing,

Pete Carmasino

Editor’s note: If you don’t already have access to our Power Gauge system, we’ve put together a special offer to get it at a big discount…

Right now, you can get a year of Marc’s Power Gauge Report newsletter at 75% off the regular price. And this offer comes with a full year of access to the Power Gauge. That means access to our system’s data and ratings on more than 5,000 stocks.