I’m guessing many of you are still excited about the AI craze… I am, too.

I can’t help it. I’ve spent decades in finance, specifically focused on using computers to generate the highest returns possible.

So, when a new computer tool promises to revolutionize the way we work… I take it seriously. And I’m having fun with it, too.

Many of my colleagues have received an e-mail from me that included some content written with artificial intelligence (“AI”). I just love how incredibly natural AI writing sounds these days.

It’s truly an incredible leap. But that doesn’t mean everything AI-related is golden.

Today, we’re going to explore a dark spot in AI. And we’ll use the Power Gauge to help us with it.

You see, the Power Gauge has identified a way not to invest with AI. And I think you should hear about what it has uncovered. After all, the fund literally has “AI” in its name.

Now, astute readers will have noticed… today, we’re talking about investing with AI rather than in AI. That’s an important distinction.

Sure, there are lots of great, and not-so-great, ways to play the AI trend. But some investment tools available to investors also claim to use AI in their processes.

The one we’re looking at today is the AI Powered Equity Fund (AIEQ).

At first glance, that name looks great. Bigwigs on Wall Street put together an exchanged-traded fund that’s specifically powered by AI.

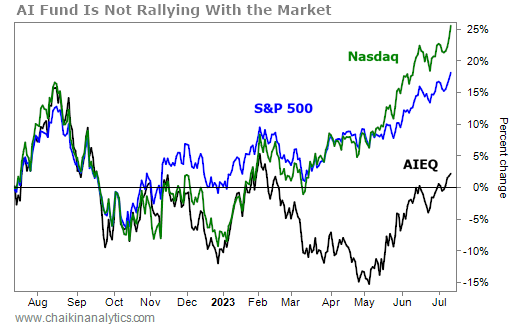

But looking at the performance… we can quickly see something is wrong.

Over the past year, the S&P 500 Index has made an incredible turnaround. And so has the Nasdaq Composite Index. They’re up more than 17% and 23%, respectively.

But AIEQ is struggling. It’s simply not participating in the rally.

It’s not just a bad year for the fund either. Zooming out even more, we find that over the past five years, the fund has barely returned 12%. The S&P 500 clobbered it over that time frame with nearly 60% returns.

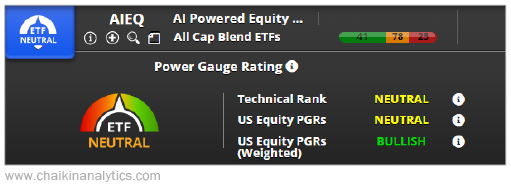

The Power Gauge sees this, too. And today, the fund earns a “neutral” rating…

Looking at the upper right-hand corner of the graphic, you’ll see the Power Bar for the fund. That represents the Power Gauge rating for each of the individually rated stocks that the fund holds.

Today, the majority of the stocks in the fund earn a neutral or worse rating from the Power Gauge. And I’m able to see that the fund ranks No. 129 of 166 funds in the “All Cap Blend” fund category.

Put simply, this fund may have AI in its name, but the Power Gauge and fund’s performance make it clear…

This is not how you want to invest with AI.

Now, that doesn’t mean I’m not excited about AI. I’m particularly bullish about how investors can leverage these new tools in their own portfolios.

In fact, I’m about to release a special presentation on the topic. In it, I’ll be speaking with my friend Dr. David Eifrig, a former Goldman Sachs vice president, about AI.

We’re going to delve into whether AI is just another stock market bubble – or something that will really change the world and economy for good. We’re also going to discuss how you can use AI to transform your wealth.

To make sure you know when my presentation is available and ensure you hear all our thoughts on the future of AI, click here.

And to give you a clue about where this is going, just remember…

The AI craze is real. But that doesn’t mean every part of it is perfect.

Good investing,

Marc Chaikin