The nightmares are becoming more common…

I’m a member of a Facebook group with about 1.2 million international female travelers. And in recent weeks, it’s clear that folks are having more trouble getting around…

You see, every third post seems to involve some kind of travel horror story.

Airlines are rescheduling flights left and right. Most flights are extremely overbooked. And perhaps worst of all, people are being forced to deal with astronomical prices…

One woman paid more than $600 to fly across the country. It wasn’t even a nonstop flight and she dealt with all sorts of headaches along the way…

The airline delayed her original flight. Then, she missed her connection and had to sleep on the airport’s floor until the next day.

To top it off, the airline downgraded her “economy plus” seat to “economy.” And yet, she still had to pay almost 1.5 times the normal price for that outcome.

But as crazy as it sounds, these types of stories are a good sign for the airline industry…

If you haven’t booked a flight recently, let me clue you in…

Airfare prices are already up 40% since the beginning of the year. And they were projected to go up another 10% in May. (The official numbers aren’t published yet.)

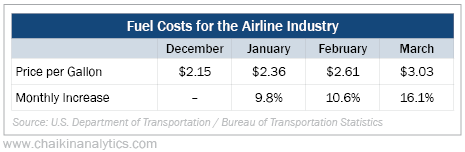

Now, you might think soaring fuel costs are to blame for rising airfare prices. After all, oil and gas prices are near record highs. And as you can see, jet fuel prices are surging…

In other words, jet fuel prices surged roughly 40% in the first quarter of 2022.

You might’ve noticed that this fuel-price increase matches the 40% bump in airfare prices so far this year. But it isn’t an apples-to-apples comparison…

That’s because fuel only accounts for 10% to 12% of airlines’ total expenses. Even after factoring in the projected 10% rise in May, the fuel-price increase still only works out to a 6% total rise in airlines’ expenses.

But remember, the airlines’ income from selling tickets has increased between 40% and 50% in 2022. So what’s the real reason for the surge in prices?

Put simply… People want to travel.

Demand for flights is increasing. We can see that trend playing out in the data, too…

The Transportation Security Administration (“TSA”) reports daily “travel checkpoint” numbers. And on Monday, the government agency said more than 2.3 million people passed through its checkpoints.

That’s up around 22% year over year. And importantly, the data shows that many folks have put their COVID-19-induced travel fears behind them…

The latest numbers are only about 7% below the number of travelers in 2019. And they absolutely crush the approximately 353,000 folks who traveled on the same day in 2020.

In other words, we’re one the edge of making new travel highs. And it’s happening even though the airlines are still recovering from their pandemic downturn.

The Power Gauge sees the growing opportunity in the airline industry as well. The system recently flipped to a “bullish” rating for the U.S. Global Jets Fund (JETS).

This exchange-traded fund has about $3.5 billion in net assets. It holds shares in all of America’s major airlines. United Airlines (UAL) is its largest holding at around 12.7% of net assets. And Delta Air Lines (DAL), American Airlines (AAL), and Southwest Airlines (LUV) each make up more than 10%.

The travel horror stories are growing. Fuel prices are high. And ticket prices are soaring.

But that isn’t stopping people from traveling. In fact, we’re on the edge of making new highs in passenger volume.

In the end, the latest numbers show that these airlines are set for a big summer. And the Power Gauge sees that coming opportunity, too.

That’s why you’ll want to check out the airline industry today.

Good investing,

Karina Kovalcik