Like many Americans, Eryn Street wanted to buy a home in recent years…

In 2020, she and her partner Jonathan Fuss were moving to Sacramento, California. They were both young professionals. She was a nurse and he was a telecom engineer.

But as they looked at the housing market, they were shocked. In July 2020, they saw that median sale prices in Sacramento had soared from $348,500 the previous year to around $380,000. (Today, they’re even higher at $480,000.)

Even worse, Street and Fuss discovered that rent prices in the area started at $3,000 a month.

The couple thought they were completely priced out of the local housing market.

Then Street’s mother suggested something they hadn’t considered…

A factory-built home.

It’s a house that gets shipped to a location – usually in a few sections – instead of being built on site. Depending on the construction date, it’s also called a manufactured home (“MH”) or a mobile home.

When Street looked into the idea, she was surprised by the low prices.

The couple ended up paying $109,000 for a three-bedroom/two-bathroom home that was built in 1992. Their monthly payment worked out to around $1,500. That factored in the mortgage, utilities, and $660 monthly lease at the community.

Keep in mind that the couple had solid careers. They’re not the kind of folks you would picture living in an MH.

The simple fact is that mobile homes get a bad rap in terms of public perception. But the reality is that the nicest ones are barely distinguishable from a “site built” house. And most MHs stay in one spot for their lifetime.

Street was thrilled to find a home she liked. As she told the Washington Post, “I was surprised by the flow of the home and love the design. It was being remodeled with new flooring and appliances.”

And the community wasn’t anything like the “trailer park” stereotypes. As Street noted at the time, “We love our neighbors and it’s really quiet… Everybody’s really sweet.”

This story illustrates two simple facts…

For one, our country’s housing shortage is forcing folks to “trade down.”

The problem is especially severe at the lower end of the housing market. Homebuilders didn’t build enough “entry level” homes in recent years.

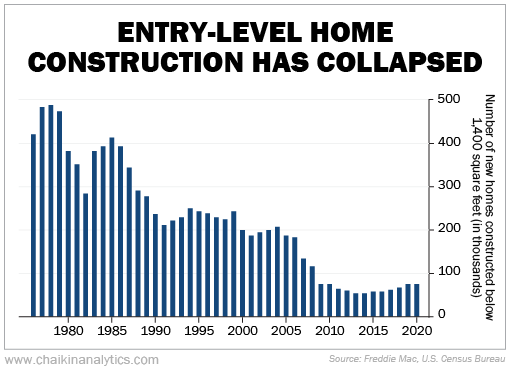

Construction of these smaller houses fell steadily over the past 50 years. And it never recovered following the housing bust in the late 2000s. Take a look…

As you can see, we’ve been neglecting the lower end of the housing market for decades.

Today, entry-level homes account for less than 10% of new home construction. That’s the lowest percentage in history.

Sure, lower mortgage rates help with housing affordability. They’ve already been moving lower this year. But that’s clearly not the only piece of the puzzle. We still need more houses.

In short, our nation’s overall housing problem isn’t going away anytime soon. It’s a massive, long-term tailwind for companies across the real estate industry.

Meanwhile, Street’s housing story also shows that manufactured housing is a clear solution to the housing shortage – especially when it comes to entry-level housing.

These homes offer huge cost savings versus buying a site-built home. According to a study from the Urban Institute, the average MH is 35% to 47% cheaper on a per-square-foot basis than new or existing site-built housing.

These numbers are from a 2017 report. A newer paper from Harvard’s Joint Center for Housing Studies notes the cost savings can range from 20% to 46%, depending on the type of MH.

Put simply, we can expect to see growing demand for manufactured housing over the coming years. And that means companies that run communities catering to MHs stand to benefit.

Good investing,

Marc Chaikin