Unemployment is near a record low. And interest rates aren’t as high anymore…

But housing is still almost as expensive as ever.

We’ve talked about the National Association of Realtors’ Home Affordability Index (“HAI”) before. This index helps us figure out whether housing in the U.S. is affordable or not.

More specifically, the HAI looks at factors like income, mortgage rates, and home prices. And it crunches the data to determine whether the typical American family can qualify for a conventional mortgage on a typical home at the national and regional levels.

As we’ll discuss today, the latest HAI data shows that many Americans are still struggling to buy the median-priced single-family home.

And now, one segment of the housing market is more than doubling the growth of another.

In the end, that development bodes well for one particular group of stocks…

The HAI came in at 98.6 in March. That’s the most recent data. It means the median income is roughly 98% of the required amount to buy the median-priced home in the U.S.

In good times, this number is a lot higher. But as I explained last September, soaring home prices are hurting would-be homebuyers these days…

The median home price peaked at roughly $421,000 in June 2022.

By this past January, it had fallen to $365,400. So despite factoring in a higher average mortgage rate of more than 6.3%, the HAI improved to 104.2 that month.

That was good. But then… housing affordability made a U-turn.

By March, the average mortgage rate climbed to more than 6.5%. And the median-priced single-family home rose to more than $380,000. As a result, the HAI slid back down to its current level.

You would think that falling housing affordability would put a damper on homebuilders. After all, they’re the companies that create the housing supply.

But that’s not the case…

The Power Gauge ranks the iShares U.S. Home Construction Fund (ITB) as “very bullish” today. This exchange-traded fund holds 37 “bullish” or better stocks and no “bearish” or worse stocks.

In fact, regular readers will recall that I wrote about the homebuilders segment in January. ITB has soared roughly 20% since then. And again, that’s despite a U-turn in affordability.

I want to touch on another important point…

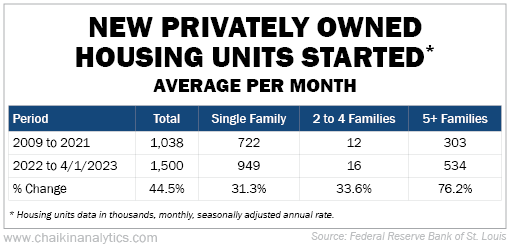

With prices soaring over the past few years, builders are finding growth alternatives beyond single-family homes. Look at the following table of “housing units started”…

Single-family housing (one unit equals one household) still dominates the overall numbers. But as you can see, this segment is growing a lot slower than multifamily dwellings…

The fastest growth rate is for developments with five or more units. That segment is up 76% over the two periods.

That’s more than double the growth rate of single-family housing.

In other words, as a society, we’re shifting toward denser and more affordable housing. And publicly traded homebuilders are driving this shift.

It’s a complicated story, but the facts are simple…

It’s getting harder for Americans to afford single-family homes. But demand is still high. And in an effort to lower costs, more Americans are turning to multifamily housing developments.

Because of elevated demand, homebuilders are still thriving. It doesn’t matter whether they’re building single- or multifamily units.

And this trend looks like it will be in place for a while. So we’ll keep an eye on it.

Good investing,

Marc Gerstein