We just endured the worst month for stocks this year…

The benchmark S&P 500 Index fell around 5% in September. The tech-heavy Nasdaq Composite Index dropped nearly 6%. And the Dow Jones Industrial Average lost about 4%.

Some of the popular mega-cap companies suffered even worse last month. For example, Apple (AAPL) fell almost 9%. And Nvidia (NVDA) tumbled roughly 12%.

Put simply… it was ugly across the board.

Now, I get it…

When stocks are falling, even the strongest-willed investors can get nervous. It might feel like you’d be better off taking all your money out of stocks and sitting on the sidelines.

But as I’ll explain today, stock weakness in September is more common than you think. And more importantly, as investors, we shouldn’t let the “September effect” scare us away…

In fact, the Wall Street Journal tried to warn folks on September 1 of this year. That day, the financial publication discussed a report about the S&P 500’s historical returns…

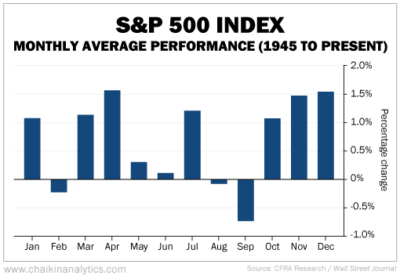

According to market-research firm CFRA Research, the S&P 500 has fallen an average of about 0.7% during September since 1945. That’s by far the worst month for stocks overall.

Fortunately, September is now in the rearview mirror. And here’s the better news…

Two of the best months for stocks are right around the corner.

According to CFRA’s report, November and December are historically two of the best months for stocks. The S&P 500 has averaged roughly 1.5% gains in each month since 1945.

Take a look…

In short, history tells us we can expect strong gains for stocks in the months ahead.

It’s also worth noting that the S&P 500 fell a lot more than average this September. So on the flip side, stocks could also rally a lot more than average in November and December.

And keep in mind that things are still looking good overall this year…

The S&P 500 is still up about 10% in 2023. Even after a brutal September, the index is still roughly in line with its 10% average annual return from 1957 through the end of 2022.

In the end, my message is simple…

Stocks are suffering through a rough patch right now. September was especially bad.

But history tells us to expect better results in November and December. And we have the data to prove it.

It’s more important than ever to rely on data and technology during uncertain times.

To that point, we’re fortunate to have the Power Gauge as our guiding light. With the system leading the way, we’ll stick to our guns and stay the course for now.

Don’t let short-term market volatility cause you to lose sight of the big picture.

Good investing,

Briton Hill