For generations, schoolkids have blamed their pets for missing assignments…

“My dog ate my homework” dates to at least the early 1900s – and perhaps even earlier. And as the years passed, some folks even started to blame their cats.

However, in almost all cases, it’s a made-up excuse. The forgetful kid just wants to blame something else for all that’s wrong in his or her world.

It’s a lot like how grown-up investors treat the Federal Reserve – and interest rates in particular.

Interest rates are the ultimate market scapegoat…

After all, higher rates draw money to fixed-income tools like bonds and away from stocks. They depress price-to-earnings ratios – and in turn, stock prices.

Higher rates also inhibit consumer spending, homebuying, and corporate investment.

But as I’ll show you today, interest rates aren’t as big of a drag as many folks assume. Specifically, we’ll focus on one piece of the puzzle that doesn’t get enough attention…

I’m talking about how interest rates play into corporate investment.

To show that, we’ll use a concept known as “net present value” (“NPV”).

NPV is how companies decide if a project is worth pursuing. But as you’ll see, NPV is “insensitive” to changes in investors’ interest-rate assumptions.

Let’s imagine ABC Company is considering a new plant to make its gadgets…

The plant will cost $100 million.

ABC Company expects the plant to make an $8 million profit in Year 1. And it projects that its profit will grow 10% annually through Year 10.

The investment bankers tell ABC Company it can borrow for 10 years at an annual interest rate of 6%.

With all those numbers, we can figure out the plant’s NPV…

We need to divide each year’s profit by 1.06 (based on the assumed 6% interest rate). Then, we need to add up all 10 years’ worth of results.

The NPV comes to about $120.3 million.

That’s well above ABC Company’s initial $100 million investment. So building the project looks like a smart move.

But let’s not jump the gun…

In our hypothetical scenario, ABC Company didn’t yet consider “sensitivity” in its projections.

It’s impossible to predict the future. ABC Company needs to prepare for all sorts of outcomes. That’s the only way it can know whether building the plant is smart or not.

In other words, it needs to know how wrong the projections can be to still produce a positive NPV.

Let’s assume ABC Company’s annual profit growth is only 3% (instead of 10%). The NPV would fall to $86.5 million. That’s below the $100 million investment. So it’s a red flag.

A profit-growth assumption of 7% per year would produce a $104.3 million NPV. That’s not great. But since that’s higher than the $100 million investment, the plant project can go forward.

Now, let’s put ABC Company’s assumed growth rate back to 10%. And this time, we’ll assume a larger 12% interest rate on the bonds. At that level, the NPV is $113.8 million.

An assumed 15% interest rate would still put the NPV at $110.9 million.

In other words… monstrously higher interest-rate assumptions won’t kill the plant.

Whether the plant gets built or not depends mainly on our profit assumptions. That’s the sensitive part of the analysis – not anything to do with interest rates.

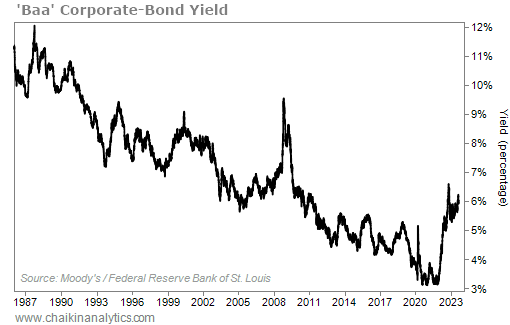

Checking in on the real world, the rate on corporate bonds is about 6% today.

You can see that in the following chart. It shows the yield on corporate bonds with a “Baa” rating from Moody’s. (Bonds with “Baa” ratings from the credit-ratings agency are considered to have moderate risk.)

Today, this rate is much higher than it was two years ago. But look at it in the long-term context…

So the 6% borrowing rate we assumed in the NPV example is very reasonable. And in the end, no plausible interest-rate assumption can kill ABC Company’s new plant.

My point is simple…

Corporate investing doesn’t hinge on the Fed today. It’s about business (profit) opportunity.

The dog might’ve eaten other investors’ homework. But you don’t need to let it eat yours.

Good investing,

Marc Gerstein