Zbigniew Brzezinski awoke to an urgent phone call at 2:30 in the morning…

More than 200 Soviet missiles were heading toward the U.S.

As President Jimmy Carter’s national security adviser, Brzezinski raced into action…

An American counterstrike would need to happen fast. The nation’s capital could be wiped out within minutes.

Then, the phone rang again…

General William Odom, Brzezinski’s military aide, misunderstood the first warning signal. It wasn’t 200 Soviet missiles heading toward the country. It was actually 2,200 missiles.

At that point, Brzezinski figured everyone would be dead soon. So he didn’t even bother to wake up his wife.

Brzezinski prepared to alert President Carter about the imminent attack.

But before he could do that, Odom called a third time…

It was a false alarm.

Fortunately, Odom and Brzezinski learned that it was a false alarm in the nick of time. So the Soviets and the Americans didn’t wipe out the world in a nuclear apocalypse.

Still, this June 1980 incident proved to be yet another close call in the decadeslong nuclear-arms history between the two countries. And perhaps worst of all…

A faulty 46-cent microchip caused the whole thing.

You see, a microchip in a communications device at North American Air Defense Command headquarters garbled its output. And the end result was the false alarm sent to Brzezinski.

Folks, more than 40 years later, microchips are still at the center of our world. But these days, the businesses that make them aren’t getting as much attention as a lot of Big Tech companies.

Don’t let that fool you…

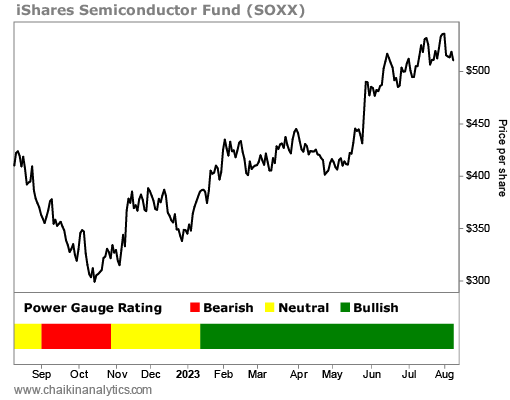

Stocks related to microchips (also known as “semiconductors”) are soaring in 2023. You can see what I mean in the following chart of the iShares Semiconductor Fund (SOXX)…

SOXX is up nearly 45% so far this year. That’s much better than the benchmark S&P 500 Index’s roughly 17% return over that period.

In the bottom panel, you’ll also notice that the Power Gauge turned “bullish” on SOXX in January. The exchange-traded fund has maintained that strong rating throughout the year.

Now, SOXX only holds about 30 semiconductor stocks. It’s a small sample of the overall industry.

The Power Gauge is able to give us a more complete look at this space. Check it out…

That’s the Power Bar ratio for the semiconductor industry. The Power Gauge currently rates 103 stocks in the space.

Right now, 50 of these stocks earn a “bullish” or “very bullish” rating from the Power Gauge. And only five stocks in the industry receive a “bearish” or “very bearish” grade.

We’re clearly dealing with a “bullish” group. Even better, analysts forecast massive growth for this industry in the coming years…

Analysts valued the semiconductor industry at roughly $573 billion in 2022. By the end of this decade, they expect its value to soar to around $1.4 trillion. That’s expected growth of about 140% over the next seven years – or a compound annual growth rate of 12%.

Folks, we’re talking about a huge opportunity. And we didn’t even mention artificial intelligence (“AI”)…

Today, companies are racing to buy processing power for AI efforts. The industry calls this “machine learning.” And it takes a boatload of processing power to accomplish.

In the end, my message should be clear…

We’ve come a long way from the kinds of microchips that nearly led to nuclear devastation in 1980. Over the past four-plus decades, this technology has made incredible strides.

In fact, most people don’t even think about the microchips that power all our devices these days. They’re too focused on the flashier software and software-services companies.

But I hope you don’t forget the humble microchip.

Good investing,

Marc Chaikin