The path from nothing to something is as good as it gets.

Think about it…

History is riddled with examples. Countries grow from undeveloped farming societies into sophisticated industrial powers. And that process creates a ton of potential wealth.

That’s why many folks in the U.S. love emerging markets…

It happened in many places after World War II. Japan and a lot of countries in Europe grew from emerging markets into developed ones as the years passed.

Then, this shift happened in Latin America. And not long after that, parts of Asia joined the party.

That’s when another dominant narrative took over…

Around 1990, China became the big star for investors in emerging markets.

Former President Jiang Zemin led the charge. Under his leadership, China carved out a meaningful role for private enterprise within a socialist society. As a result, its GDP grew about 12% annually. And the Shanghai Composite Index rose at an annual rate near 30%.

But in recent years, China and the U.S. have started sniping at each other. China’s economy is slowing, too. And it’s dealing with other problems – like youth unemployment.

So now, another country is picking up the baton for U.S. investors…

As I’ll show you today, the Power Gauge is all over this country’s transition. And right now, our system is telling us to pay attention…

I’m talking about India.

Earlier this month, Indian Prime Minister Narendra Modi hosted other economic powers at the G20 Leaders’ Summit. And importantly, he scored a diplomatic triumph at the event…

In short, attendees unanimously adopted the Delhi Declaration. With this statement, the so-called “Group of 20” countries agreed to all work together toward growth.

Now, you might think that’s just a bunch of bureaucratic mumbo-jumbo. But here’s why it’s important…

India is a charter member of the “BRICS” group – which stands for Brazil, Russia, India, China, and South Africa. Goldman Sachs economist Jim O’Neill first used the acronym in 2001. It describes the emerging markets he expected to lead the global economy by 2050.

This collection of emerging markets will soon grow, too. Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates will become members on January 1, 2024.

The BRICS group isn’t perfectly cohesive, though. Some members (like China) advocate for more competition with the West. And India is among the members that favors cooperation.

Because of that, the country is friendlier to foreign investment than other BRICS countries. And fortunately for India, its “play nice” attitude is paying off…

Just look at Apple (AAPL). The iPhone 15 is the first model to feature some “made in India” versions on launch day. That will surely eat into China’s manufacturing dominance.

The experts are taking notice, too…

ASK Investment Managers expects India to have the highest working-age population by 2030. It also forecasts India to become the world’s third-largest economy by 2027.

Meanwhile, India’s NIFTY 50 large-cap stock index has returned nearly 11% annually over the past decade. That tops the 6% and 2.7% returns in the U.S. and China, respectively.

Like the experts, the Power Gauge is also all over India’s potential…

Our system is currently “bullish” or “very bullish” on all 11 India-focused exchange-traded funds (“ETFs”) that it rates. For comparison, the Power Gauge is “neutral” on eight Chinese ETFs right now. And it’s “bearish” or “very bearish” on the other 35 Chinese ETFs.

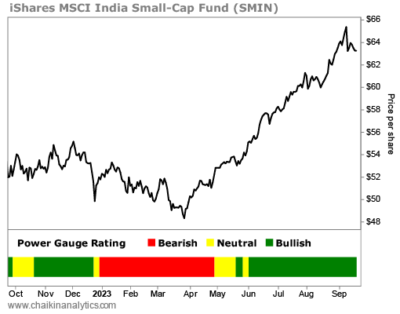

Within India, small caps are the hottest option right now. Among all the India-focused ETFs, the iShares MSCI India Small-Cap Fund (SMIN) has performed the best. Take a look…

SMIN is up around 21% this year. A lot of the gains (roughly 18%) have occurred since the Power Gauge turned “bullish” in mid-May. The S&P 500 Index is only up about 4% in that span.

In the end, our takeaway is simple…

Not every investor wants to dabble in developing countries. But if you’re going to do it, be sure to use the Power Gauge. It will pinpoint the best global opportunities for you.

Today, China is out… And India is in.

Good investing,

Marc Gerstein