It seems like almost everything is connected to Russia’s war in Ukraine these days…

Even somewhere as far away as Brazil.

In this case, the connection is iron ore…

You see, the top six countries in terms of iron ore production are Australia, Brazil, China, India, Russia, and Ukraine.

That means iron ore is at the heart of Russia’s war in Ukraine. And beyond that, this ongoing conflict has direct implications for the export market of Brazil – a country on the other side of the world.

In today’s essay, I’ll show you exactly what the Power Gauge thinks about this unusual connection to the war in Ukraine. And importantly, I’ll detail a simple way to capitalize on it…

Brazil makes an awful lot of coffee. In fact, it’s the world’s leading producer of coffee beans.

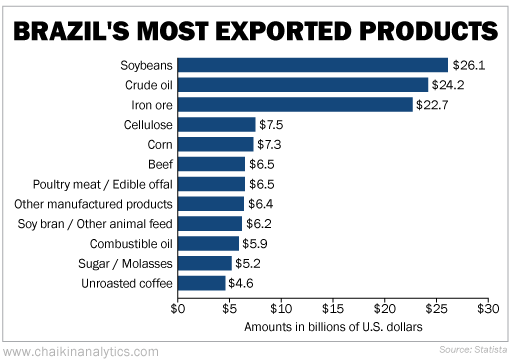

But as it turns out, coffee is far down the list of Brazil’s most exported products. Soybeans, oil, iron ore, and other products beat out coffee in terms of export dollars. Take a look…

Why is this important?

Well, let’s go back to the list of iron ore producers…

It’s full of turmoil, lack of trust, and broad logistics issues.

Obviously, Russia and Ukraine are in turmoil right now. China is hard to trust – at least for many Americans. And Australia and India are so far away that the cost to import iron ore from those countries isn’t a good option for the U.S.

That makes Brazil the best choice for U.S. iron ore imports. The country also seems like a good choice for oil imports as well.

The U.S. is in a precarious situation right now. Commodity shortages are a matter of national security. And iron ore is obviously important to our country.

We aren’t alone here in the U.S., either. The world is in a tough spot when it comes to shortages – and more and more countries are turning to Brazil to solve this problem.

The Power Gauge sees this development, too. It’s a big reason why our proprietary system rates the iShares MSCI Brazil Fund (EWZ) as “very bullish” today.

And as you can see in the following chart, EWZ is in a big uptrend right now…

First, notice the longer-term trend. That’s the blue line in the main chart. EWZ crossed above its long-term trend back in January. That means the exchange-traded fund (“ETF”) is outperforming its own historical price action over the past couple of months.

In other words, EWZ’s price is headed up. The momentum is in its favor.

Next, look at the Chaikin Money Flow indicator in the first lower panel. As we’ve explained before, this indicator measures institutional investors’ engagement with the ETF. When it’s green, institutional investors are likely accumulating a position. And when it’s red, they’re likely heading for the exits.

Finally, look at the relative strength versus the S&P 500 Index for EWZ. In recent months, EWZ is outperforming the broader market. That kind of outperformance is likely to attract more capital.

This chart paints a clear picture…

Due to the ongoing war between Russia and Ukraine, the world is in trouble. Iron ore and oil supplies are being disrupted. And market participants are voting with their money.

In today’s market environment, Brazil is a winning choice. Check it out.

Good investing,

Pete Carmasino