Folks, a major change is taking place in the world of biotechnology…

We’re entering an era of personalized medicine. That’s where a doctor can order a genetic work-up and prescribe treatment based on the very genetic markers that make you an individual.

Beyond that, artificial intelligence (“AI”) is helping in the world of drug development. And it’s only getting better.

Specifically, I’m talking about the fact that AI tools can “brainstorm” millions of new possible drugs. And they can do it faster than any human can.

Just those two things together mean we’re on the edge of a revolution in modern medicine. But there’s something else that you’ve probably heard about…

A new class of weight-loss drugs are on the market. And it seems like just about everyone is talking about them.

The industry calls them glucagon-like peptide 1 (GLP-1) agonists. But you’ve probably heard about the brand names – Ozempic, Wegovy, and Mounjaro. They have become wildly popular.

Folks, it’s looking like humanity may have legitimately cracked the code on weight loss. These new drugs literally change the way you think and feel about food.

And with all this change taking place, it’s no surprise the Power Gauge has picked up on the strength in biotech….

You don’t have to be a biotech expert to notice that something big is going on. That’s the magic of the Power Gauge.

You see, the Power Gauge rates individual stocks using 20 of the most important factors on Wall Street. And together, those factors go through a proprietary weighting system.

The final output is a simple rating – from “very bullish” to “very bearish” – for any stock.

But when it comes to entire sectors and subsectors, we can use the Power Gauge to get a bird’s-eye view.

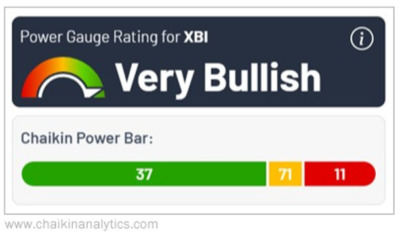

With biotech, we can track it with the SPDR S&P Biotech Fund (XBI). It’s an exchange-traded fund (“ETF”) with holdings across the biotech subsector. Take a look at this screenshot from the Power Gauge…

This shows XBI’s Power Bar rating. The Power Bar allows us to quickly see the rating breakdown for every rated stock in an ETF.

In the case of XBI, that’s the proprietary weighting of the 20-factor Power Gauge report for 119 holdings with ratings in our system.

Now, our testing shows that ratio between the bullish and bearish stocks is key. And as the Power Gauge shows, biotech stocks are considerably more “bullish” than they are “bearish.”

Specifically, XBI holds 37 stocks with a “bullish” or “very bullish” rating. And only 11 of its stocks earn a “bearish” or “very bearish” rating.

Combining that with the fund’s recent uptrend – up about 24% over the past six months – means a “very bullish” overall rating on XBI itself.

In other words, biotech is “very bullish” right now.

Now, in the world of medicine it always feels like there’s some new “gee whiz” claim. And I’m sure you’ve felt like one day scientists are telling you something like chocolate is good for you… and the next day they say it’s bad.

Don’t let that distract you from the real changes that are taking place. We’re in the early stages of a medical and biotech revolution.

The Power Gauge sees it through the individual ratings of biotech stocks. And when bringing them together, like in an ETF such as XBI, we see that the entire subsector is “very bullish.”

So if you’re not watching biotech already, I recommend you look into it.

Good investing,

Vic Lederman

P.S. In fact, our friends over at our corporate affiliate Stansberry Research just shared an emotional story from one of their own employees about the incredible power of biotech.

It’s the most personal – and eye-opening – message that Stansberry has ever shared. And as the folks there say, this message is also at the center of one of the biggest investing stories of the next decade or more.

Check it out right here.