I hope you didn’t listen to the eggheads…

Many Wall Street analysts predicted that the surge in interest rates in 2022 would spell disaster for the U.S. economy. They believed this shift would cause a recession last year.

But they were wrong.

Instead, the eggheads should’ve listened to Benjamin Graham and David Dodd…

Longtime Chaikin PowerFeed readers know all about these two “fathers” of value investing. They published the famed book Security Analysis all the way back in 1934.

And yet, you don’t hear a lot about Graham and Dodd these days. Most people simply don’t get as excited about value investing as growth investing. It’s just too boring to them.

Over the past five years, the Vanguard Value Index Fund (VTV) – an exchange-traded fund of more than 340 large-cap value stocks – is up 49%. Meanwhile, the Vanguard Growth Index Fund (VUG) – which holds more than 220 large-cap growth stocks – has more than doubled VTV’s performance… It’s up 120% over the same time frame.

So today, many investors might assume that Graham and Dodd – although historically significant – are outdated. That’s a shame…

As I’ll explain today, a little-known part of Graham’s and Dodd’s work could’ve helped the eggheads. And they could’ve avoided misinterpreting accurate data with bad forecasts…

In short, I’m talking about trends. Specifically, trend study is a key part of forecasting…

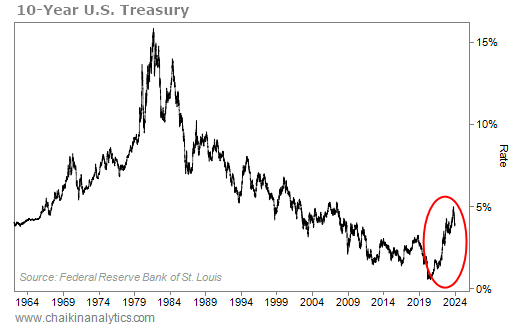

Consider the trend change in the 10-year U.S. Treasury note’s yield, for example.

The big spike in this yield (and other similar rate trends) spooked many economists in recent years. It jumped from about 1% at the end of 2020 all the way up to nearly 5% in October 2023. You can see the dramatic rise in the chart below…

According to the eggheads, a jump like that should’ve crushed borrowing. A lot of U.S. businesses should’ve canceled projects. And U.S. consumers should’ve bought less.

That should’ve led to a recession last year.

But when you consider the trends in larger context, these analysts’ work is flawed…

Graham and Dodd touched on this point in Security Analysis. In the book, they explained that trends “obey no mathematical rules and therefore may be too easily exaggerated.”

Graham and Dodd were specifically talking about earnings. But their point applies to any trend – even interest rates. As they went on to say in the book…

When an average is taken over a period that includes a number of deficits, some question must arise as to whether or not the resultant figure is really indicative of the earning power…

This point is of considerable importance in view of the prevalence of deficits during the depression of the 1930s. In the case of most companies, the average of the years since 1933 may now be thought more representative of indicated earning power than, say, a 10-year average 1930 to 1939.

When analyzing earnings trends from the 1930s, Graham and Dodd skipped over 1930 to 1932 – the years before the recovery started from the Great Depression.

Considering the scale of the crisis, those years reflected unusual developments. They weren’t properly “representative of indicated earning power.”

Stock analysts today also omit unusual items that don’t represent true earning power. But it’s important to resist the temptation to oversimplify…

Instead, we use the Power Gauge to zero in on stocks.

Our model doesn’t rely on broad market generalizations. Instead, it analyzes fundamentals, valuations, and sentiment for each stock.

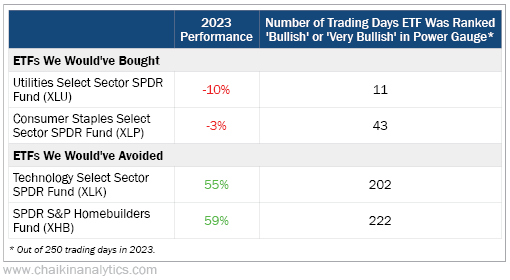

Let’s consider if an investor stuck with the interest-rate narrative in 2023…

They would’ve gone “all in” on traditionally recession-resistant areas like utilities and consumer staples. And they would’ve avoided tech- and homebuilding-related stocks.

Here’s what happened last year with those four sectors…

As you can see, an investor would’ve done poorly if they followed the interest-rate narrative and piled into utilities and consumer staples. They would’ve missed the big gains in tech- and homebuilding-related stocks, too.

Utilities and consumer staples both ended the year in the red. And tech stocks and homebuilders both gained nearly 60% in 2023.

So instead of following the crowd with bad forecasts, we’ll keep following the Power Gauge.

Good investing,

Marc Gerstein