Everyone is watching the Federal Reserve once again today…

This afternoon, the central bank will wrap up its latest policy meeting. And it will decide whether or not to raise interest rates for the 12th time since March 2022.

Inflation is down from its peak. So a lot of folks believe this rate-hiking cycle is over.

And yet, interest rates are stubbornly high…

The 10-year U.S. Treasury note’s yield has remained above 4% since the end of July. It’s now at about 4.3%. That’s the highest yield for the 10-year Treasury since 2007.

Rising interest rates have taken their toll on technology stocks…

At Chaikin Analytics, the tech-heavy Invesco QQQ Trust (QQQ) is one of our gauges for the tech sector.

QQQ recently fell below its 50-day moving average for the second time in this year’s rally. The exchange-traded fund is now down around 4% from its mid-July high.

Meanwhile, the more speculative ARK Innovation Fund (ARKK) has fallen a lot further. It has plunged roughly 18% from its peak at around the same time.

Put simply, rates remain around their highest level in 16 years. As a result, many investors are shifting their focus away from growth sectors (like technology).

Instead, they’re putting their money to work in a formerly left-for-dead sector…

The recent action in the market reminds me of an old Wall Street saying…

A bull market doesn’t end until the last bear throws in the towel.

Yes, the market is volatile right now. Specifically, growth stocks are getting hit hard. But fortunately for bulls like us, plenty of bears are still holding their towels today.

I’m sure you’ve seen the negative headlines in recent days…

I expect the current short-term weakness to persist through September. But don’t let that fool you…

The “rolling” bull market is alive and well.

In early June, I showed Chaikin PowerFeed readers that the energy sector was in rough shape. It was one of the worst-rated sectors in the Power Gauge at the time.

But I also encouraged folks to “watch this important sector” for an opportunity.

It’s a different story today. Investors are rotating out of growth sectors like technology. And instead, they’re pouring cash into cyclical sectors like energy.

The Power Gauge is all over this recent shift in the market…

We can track energy stocks through the Energy Select Sector SPDR Fund (XLE). This exchange-traded fund is soaring. It’s up around 19% since the start of June.

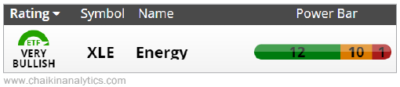

And as you see below, the Power Bar ratio of XLE’s holdings is now firmly in the “very bullish” zone. The ETF only has one “bearish” or worse holding today…

My point is simple…

An opportunity almost always exists somewhere. Investors aren’t completely fleeing from the market today. They’re just shuffling their money around to other sectors.

I’m still “bullish” on stocks today. And to maximize our chances of success, we need to focus on stocks in strong industry groups with “bullish” or better Power Gauge ratings.

So as this mini correction plays out, keep your eye on the energy sector.

Good investing,

Marc Chaikin