Apple (AAPL) is not going to disrupt the auto market.

The tech giant spent about 10 years on a research-and-development project to make electric and self-driving car. It called the effort “Project Titan.”

Now, Apple didn’t formally announce the project. But there have been plenty of rumors over the years. These included numbers of employees working on the project and types of designs.

And late last month, Project Titan made headline news. On February 27, reports surfaced that Apple Chief Operating Officer Jeff Williams and project leader Kevin Lynch told employees that the effort would be scrapped.

And now, we’re learning a lot more about it…

Back in 2014, Alphabet’s (GOOGL) autonomous-driving prototype had already dazzled Silicon Valley. Many folks there assumed autonomous driving would eventually be popular everywhere.

And in theory, this market could have been just right for Apple.

Its playbook often included reinventing existing products and using its technology to take them to new heights.

And given its size at the time, Apple thought it needed something like the large $2 trillion transportation market to make a big difference in expanding its business.

Meanwhile, Apple’s engineers had finished developing the Apple Watch. They wanted to work on something new. And CEO Tim Cook worried that many of them would leave Apple and go to Tesla (TSLA).

The solution? Reinvent the automobile and take it to new levels using Apple technology – hence the birth of Project Titan. The project seemed to check all the boxes.

But in reality, it didn’t…

For one thing, some executives weren’t convinced.

Chief Financial Officer Luca Maestri was against it. He knew from his prior stint at General Motors’ (GM) European division that this was a very low-margin business.

Maestri had a point. Apple’s five-year average operating margin was 28.2%. The auto industry median margin was 7.7%.

Craig Federighi, Apple’s top software engineer, was another skeptic. So was star designer Jony Ive.

And at the outset, Apple even considered buying Tesla. But Tesla CEO Elon Musk put an end to that potential deal by saying he wouldn’t step down from his position. Later, in 2017, Tim Cook refused to meet Musk when he came back trying to offer Tesla to Apple.

And Project Titan would suffer from indecisiveness mixed with overambition.

Steve Zadesky, the project’s original leader, wanted to build an electric car. That put him on the same page as those who considered buying Tesla.

Bu Ive wanted a self-driving vehicle. He won.

Even this didn’t settle everything…

Keep in mind that there are various levels of self-driving. Apple veered between Level 3 (in which humans participate in driving) and Level 5 (in which humans don’t play a role in driving).

Ultimately, Apple chose the most ambitious Level 5.

The vehicle would have likely looked like a minivan. It would have included touchscreens folding down from the roof as controllers, piped-in external sounds, a giant TV screen, and windows that adjusted their own tint.

But it wouldn’t have a steering wheel. And some company insiders feared that consumers wouldn’t like that.

The goal was cut again in 2023. Apple would offer a less-revolutionary package. It would have a steering wheel, lane control, and cruise control. But the production cost would be about $120,000.

Finally, this February, Apple gave up. All told, it spent about $10 billion on the project.

Sure, $10 billion is a big number. But fortunately for Apple, the company is massive enough to absorb this hit…

Keep in mind that $10 billion is only about 0.4% of the company’s staggering $2.7 trillion market cap. And it’s just 2.5% of trailing 12-month sales.

So Apple’s stock barely reacted after the reports emerged that the company was abandoning Project Titan.

Between February 26 and March 1, the S&P 500 Index rose 1.3%. AAPL shares fell just 0.8% over the same time frame.

Despite this, keep in mind that Apple’s stock isn’t totally out of the woods. And the Power Gauge shows us why…

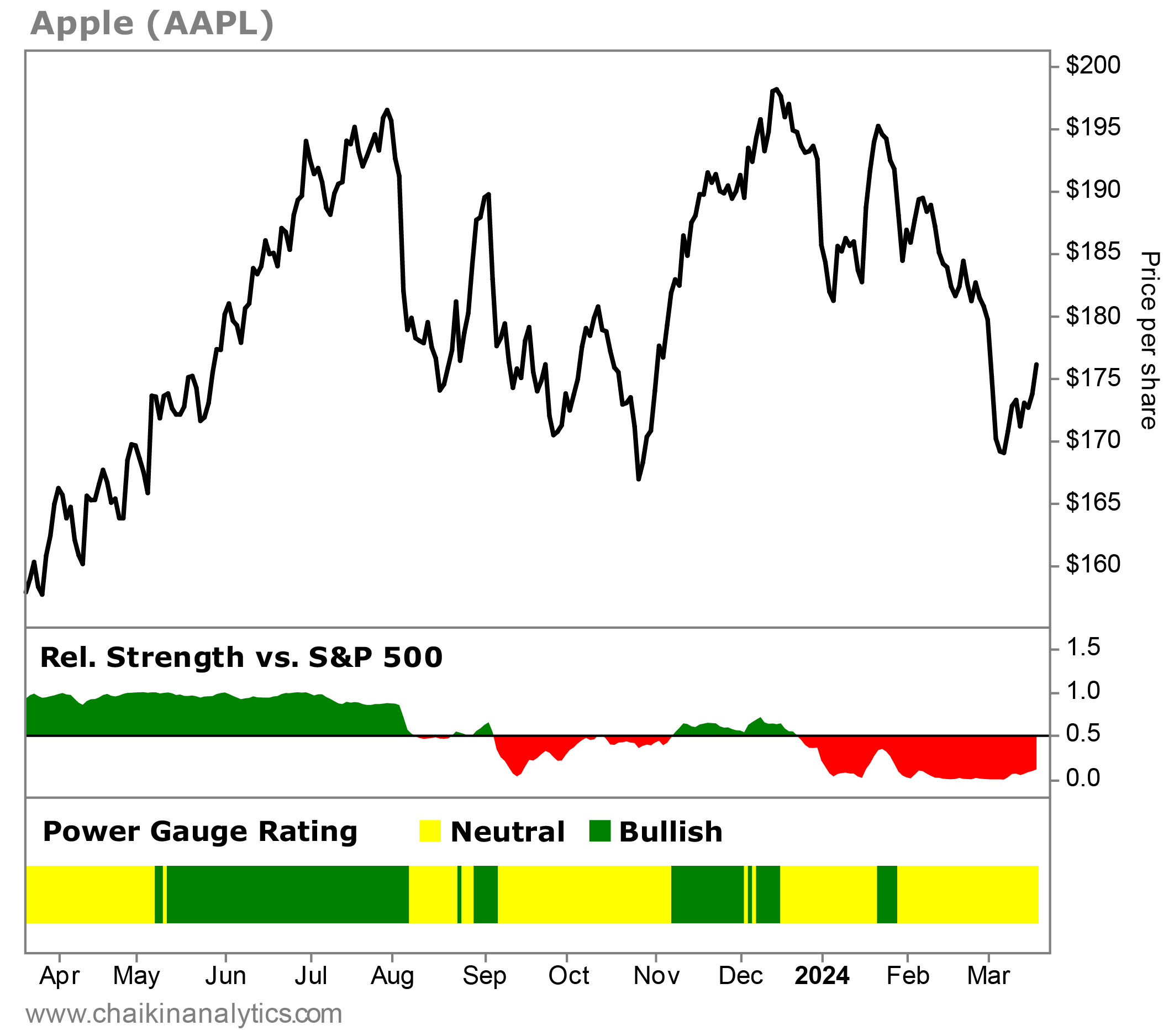

In the chart below, you can see that the stock’s relative strength versus the broad market has ranged from lackluster to weak since last fall.

You can also see that over the past year, the Power Gauge has been occasionally “bullish” on Apple. But it’s more often been “neutral” – like it was before and after the company decided to scrap Project Titan.

And as the chart shows, the Power Gauge is still “neutral” on Apple today…

This shows the benefits of size.

A smaller company might have seen its shares – and Power Gauge Rating – suffer badly after such a sloppy and expensive failure. But with such a massive market cap, Apple can withstand the hit.

Putting it all together, a $10 billion miss won’t crush Apple. But the Power Gauge is still cautious on the company overall today… and I’ll take my cues from there.

Good investing,

Marc Gerstein