A runaway cement truck recently slammed into a house in my area…

And no one was behind the wheel.

The crash wrecked two cars inside the garage. Engineers condemned the house due to the structural damage.

The owner was forced to move out. But fortunately, no one got hurt.

A cement truck with 10 cubic yards of material inside it can weigh close to 66,000 pounds. So if anyone had been in the path of the truck, it could’ve been much worse.

Now, I’m not sure what happened. I assume the truck got stuck in gear and took off.

The specific details don’t matter. But this incident did serve as a powerful reminder to me…

You see, I assume the driver didn’t follow the proper process before leaving the truck. He likely skipped a step – probably something as simple as not turning the engine off. And ultimately, someone else lost two cars and their house.

We put safety protocols in place for a reason. They’re designed to protect everyone from unpredictable events – like a runaway cement truck crashing into a house.

That’s an extreme example, of course.

But as I’ll show you today, it’s a lot like predicting market outcomes based on economic conditions. If you follow the proper process, you’ll be ready for an unpredictable event…

A year ago, nearly everyone was playing defense.

The S&P 500 Index had plunged around 25% from its December 2021 peak through its October 2022 bottom. And many investors feared that things would get even worse.

In short, they were predicting market outcomes based on economic events that had already happened…

One of the main factors I’m talking about is inflation.

The Consumer Price Index peaked in June 2022 at more than 9%. Even after it had started subsiding, a lot of folks still held on to the possibility of terrible economic outcomes…

Defaults, slowdowns, and a potential recession dominated the headlines.

But as I learned early in my career, guessing what might happen based on economic events is a fool’s errand. You’ll be a lot more successful if you follow the proper process…

As part of my process, I always balance my research between economic data and market performance. That’s a fancy way of saying I read a lot of stuff.

I can’t help but get fascinated with the economic forces that shape our financial landscape. And yet, I try not to get swayed one way or the other.

It’s something that can be hard to learn. But it’s a lot easier when you have a process. And as part of that, I try to read and dissect the known to prepare for the unknown every day.

Did I expect Federal Reserve Chair Jerome Powell to turn “dovish” last week?

Nope, not even close.

But since I have a process in place, I didn’t need to see it coming. I was prepared for unpredictable events. And it all started with the Power Gauge…

The Power Gauge is a key part of my process.

Importantly, our system told me something was changing all the way back in January…

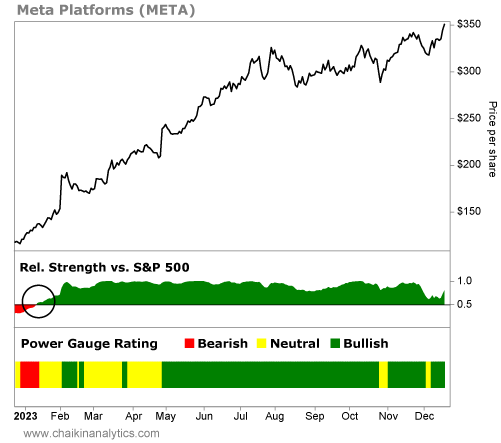

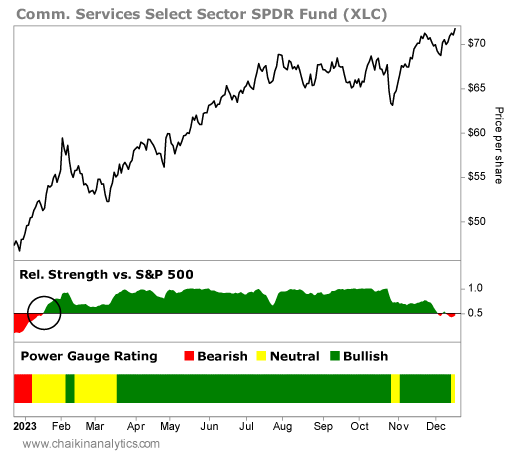

This change related to the communications services sector – which we track through the Communication Services Select Sector SPDR Fund (XLC). It also involved XLC’s top holding, Meta Platforms (META).

In the following two charts, you’ll notice that Meta Platforms’ trend changed just before XLC. You can see what I mean in the relative strength panels along the bottom. Take a look…

In other words, Meta Platforms started outperforming the S&P 500 Index just before its broader sector did. That’s an important part of my process called a “bottom up” approach.

A bottom-up approach helps us look for individual stocks that are making key changes. Then, we can dig deeper into the larger sector to see if a broader opportunity exists.

In this case, we could’ve continued our process and bought XLC after its trend changed. If you would’ve done that, you’d be sitting on a gain of about 40% right now.

That’s nearly double the S&P 500’s roughly 21% return over the same period.

In the end, the markets don’t follow a script. The financial world is full of unpredictable events. It’s sort of like when a runaway cement truck hits a house.

You need to have a process. So when the unexpected happens, you’ll be ready to act fast.

That’s why I’m glad to have the Power Gauge in my corner.

Good investing,

Pete Carmasino