Editor’s note: We’ve seen plenty of volatility in the market over the past few months…

In mid-July, the S&P 500 Index hit an all-time high. Then, it collapsed over several weeks… rallied through mid-August… and sharply pulled back again earlier this month.

Now, stocks are hitting new all-time highs.

But no one really knows what lurks around the next corner…

The presidential election is getting closer. Political rhetoric is ramping up on both sides of the aisle. And we could see another uptick in bad volatility in the weeks ahead.

In uncertain environments like that, using the best available data for stock picking is critical. That also goes for figuring out which stocks to avoid.

As Chaikin Analytics founder Marc Chaikin explains in this classic essay, his one-of-a-kind Power Gauge system shines in this area…

“Based on the bearish Power Gauge rating, I think the risk of a negative earnings surprise is too great.”

I said those words in 2012, as I was appearing for the first time on CNBC’s Fast Money Halftime Report.

On the panel next to me was Jon Najarian. I’m guessing you’ve heard of him…

The NFL-linebacker-turned-high-profile-trader had become a household name in the financial world by then. He would go on to sell his publishing and trading platforms, optionMONSTER and tradeMONSTER, to E-Trade just a few years later for $750 million.

Najarian was at the peak of his financial career. And although I’d been making the rounds on CNBC, this was the first time we had crossed paths.

The stock we were talking about was online travel agency Priceline, which later changed its name to Booking Holdings (BKNG).

Priceline was one of Jon’s bullish trades at the time. And I had just told CNBC viewers that it looked too risky.

The thing is, I didn’t know anything about Priceline.

But I did have the Power Gauge to guide me. And that was all I needed…

As longtime readers know, the Power Gauge is the culmination of my life’s work.

It combines more than five decades’ worth of data-driven market research. And it packages everything I’ve learned about the markets into actionable information for every stock it processes.

So I didn’t need to know much about Priceline. I just typed in the ticker and got my report.

Immediately, I saw that Priceline was set up to release disappointing earnings. The Power Gauge made it clear.

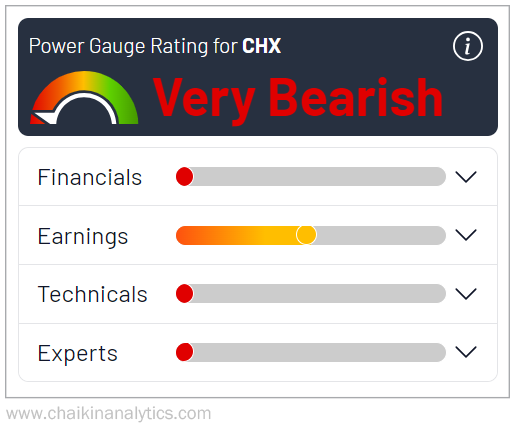

Obviously, the interface for the Power Gauge has gotten more refined over the years. Here’s an example of another stock that the Power Gauge turned “very bearish” on recently…

You’ve probably never heard of ChampionX (CHX).

But that’s not important – because the Power Gauge has.

Each of these sliders is backed by data that can be further explored. And the data shows us that ChampionX is in a risky spot for investors right now.

That was the kind of setup I saw when I told Jon that Priceline looked like a no-go. The Power Gauge had provided me with the most important (and most relevant) information.

Again, Jon was excited about the stock. But he was a professional. And he was willing to reexamine his ideas.

The interview ended with Jon saying, “I’m going to take a harder look, since Marc Chaikin doesn’t like it.”

That was Monday, August 6, 2012. On Wednesday, the day after Priceline’s earnings, the Halftime Report did a highly unusual follow-up.

The host started by asking Jon, “Chaikin spooked you a little bit?”

“He did indeed. And I think… a lot of folks followed Mr. Chaikin. Those of us that picked up some cheap out-of-the-money puts… well, they worked out like a charm.

“Those puts went from like $1.80 last night to $15, $16,” Jon continued. “Again, great call by Marc Chaikin. And thanks, Marc, for helping me out.”

In short, the Power Gauge was right. Priceline missed earnings. And Jon listened to me, made a bet against the stock, and racked up big profits instead of taking major losses.

Now, one great call is just that – a single great call.

But it was only possible because I had the Power Gauge at my side.

The Power Gauge uses the best data available to help individual investors make consistently great calls. And my goal is to share that power with as many investors as I can.

Good investing,

Marc Chaikin

P.S. Right now, I’m leveraging the Power Gauge to find the exact group of stocks that could crash next in the wake of last week’s Federal Reserve meeting…

Put simply, the window of opportunity to position yourself is narrow. That’s why I recently went on camera to share the story – including the No. 1 step you should take to protect yourself.

It’s information you can’t afford to ignore moving forward. Get all the details right here.